Following recent communications from Brown Shipley, we are delighted to welcome you to this dedicated website page, where you can find more details on what is on offer if you decide to transfer to Saltus, including:

- A video introducing you to our Select proposition and the team that will be supporting you as a client of Saltus

- Frequently asked questions

- Important documents, such as terms and conditions and key feature documents

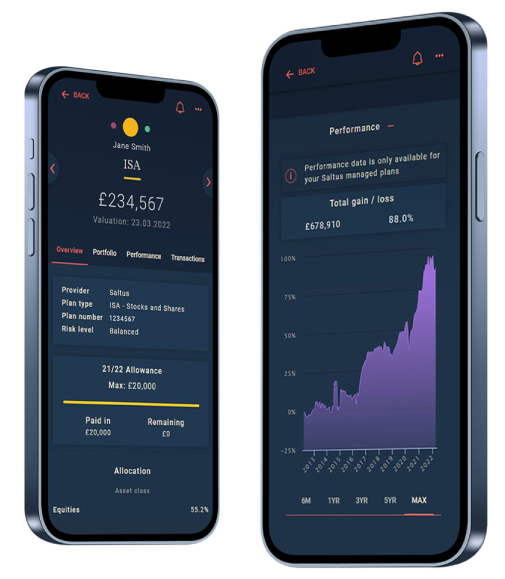

- An overview of the Saltus Portal

- A bit about who we are

If you have any questions that are not answered by the information on this website page, please see contact details at the bottom of the page for Gia Powell (Head of the Personal Advice Desk) and Joe Maguire (Managing Director of Saltus Select), who will be very happy to help you.

Frequently asked questions...

Who are Saltus?

Saltus is an established wealth management company with over 200 employees and over £5bn in assets under management. Our mission is to improve everyone’s relationship with their wealth: to make it a positive force for their future and at the same time to prevent it being a source of anxiety.

We started life as an investment management firm in 2004 to bring institutional calibre fund management to UK private clients. Yet, over the years, we realised that providing high-quality investment management is just one of the ways we can help clients achieve their aspirations. Saltus Financial Planning was launched in 2015 with the aim of being an industry leader in providing financial advice, so our clients can rest assured their money is being looked after by experts.

Today, we offer both award-winning fund management through Saltus Asset Management and Chartered financial planning services through Saltus Financial Planning.

What is happening?

Following a strategic review, Brown Shipley have decided to focus their client offering on portfolios of over £500,000. Brown Shipley have partnered with Saltus to find a new homes for these clients, and Saltus will be arranging to issue direct offers to provide uninterrupted financial planning and investment services. You will have the opportunity to sign up for Saltus services via DocuSign. Once the DocuSign has been completed and submitted, Saltus will liaise with Brown Shipley to transfer your assets to the Saltus Platform.

What do I need to do to proceed?

You will receive a welcome email from Joe Maguire on behalf of Saltus Financial Planning and a personalised pack emailed via DocuSign ([email protected]) which will outline the proposed transfer, benefits, costs and action required. We will also point out any risks or potential disadvantages to enable you to make an informed decision. To proceed you simply need to open and digitally sign the DocuSign document; we will take care of the rest.

This will include running electronic anti money laundering searches and we may need to contact you for supplementary evidence (e.g. copy of passport, driving licence, utility bill) should there be any anomalies.

Who will be managing my portfolios?

Saltus Asset Management are an award-winning discretionary fund manager. Saltus portfolios are in the top quartile for performance in the ARC Private Client Indices (PCI) benchmark over 3 and 5 years. The ARC PCI is an independent benchmark that assessed nearly every major wealth manager in the UK. Saltus Asset Management have no input into the benchmark and how the data is presented.

Choosing Saltus Asset Management as your discretionary fund manager means that:

1) Your portfolio will be diversified widely across asset classes, geographies, themes and styles to reduce the reliance on any individual risk factor. Saltus Asset Management are unconstrained in their investment choices and will look across the full range of instruments to locate the best opportunities.

2) The risks of your portfolio will be monitored continuously to ensure all funds remain suitable for your needs. This risk-controlled approach can result in better net returns for clients who are drawing money from their investments.

Can I change my mind?

You have the right to cancel and details will be provided once you’ve submitted your acceptance as these will depend on the product. However, if the value of your investment dropped a few days before you cancelled, you might not get the full amount that you invested back.

How long will the transfer take?

How will I be notified when the transfer is complete?

You should expect to receive an email confirming when the transfer of your investments is complete followed by an invite to access your Saltus portal account. Your relationship manager will also be in touch in due course to go through our onboarding process.

I have a portfolio held within a Dentons Fairmount Pension. How will a transfer to Saltus impact my pension?

Your Fairmount pension wrapper will remain intact and unchanged. If you choose to transfer, Saltus will simply replace Brown Shipley as your appointed investment manager. All other aspects of your pension will remain as they are, and Dentons will continue to act as provider and Trustee. The transfer of your portfolio does not count as a pension contribution, and your annual pension allowance is unaffected. Brown Shipley will provide Saltus with the details of any regular pension contributions and/or withdrawals so these can continue unchanged. Pension payments will continue to be made to you on the 20th of every month, and we will coordinate the transfer timing if required to ensure that any regular withdrawals are not affected.

Completing the Saltus application pack also provides Dentons with your instruction to transfer investment management of your Fairmount plan from Brown Shipley to Saltus. Dentons will instruct Brown Shipley to liquidate your portfolio and transfer the proceeds to them as cash. Dentons will then instruct Saltus to invest the proceeds on your behalf into your new Saltus portfolio.

I have a portfolio held within an AJ Bell InvestCentre Pension. How will a transfer to Saltus impact my pension?

Your InvestCentre pension wrapper will remain intact and unchanged. If you choose to transfer, Saltus will simply replace Brown Shipley as your appointed investment manager. All other aspects of your pension will remain as they are, and AJ Bell will continue to act as provider and Trustee. The transfer of your portfolio does not count as a new pension contribution, and your annual pensions allowance is unaffected. Brown Shipley will provide Saltus with the details of any regular pension contributions and/or withdrawals so these can continue unchanged. Pension payments will continue to be made to you on their existing schedule and we will coordinate the timing of the transfer if required to ensure that any regular withdrawals are not affected.

Completing the Saltus application pack also provides AJ Bell with your instruction to transfer investment management of your InvestCentre plan from Brown Shipley to Saltus. AJ Bell will instruct Brown Shipley to liquidate your portfolio and transfer the proceeds to them as cash. AJ Bell will then instruct Saltus to invest the proceeds on your behalf into your new Saltus portfolio.

Will my regular ISA or General Investment Account withdrawals or contributions continue while the transfer is in flight?

If you make regular contributions into your existing investments, these instructions will need to made with your new Saltus accounts. Any payments that go into your Brown Shipley account after transfer will be paid over to your Saltus account automatically until your Brown Shipley account is closed.

Are my regular withdrawals or income payments affected?

If a scheduled payment out is due on or around the day of transfer, we will wait until the payment has been made before transferring your assets to remove any potential disruption to your regular income.

Can I transfer my ISA to Saltus?

Yes you can, and transferring your ISA will not affect your current tax year allowance. You can ask your Brown Shipley adviser for confirmation of your contributions and you may wish to seek independent tax advice.

Are there any initial fees?

Any reference to initial fees in the Financial Planning Agreement do not apply in this instance.

How do I know my money is safe at Saltus?

Saltus has chosen to not hold client assets or client cash directly. Instead, we use a specialist firm known as a custodian to do this. After an extensive review of providers looking at a range of factors including expertise and financial strength, we selected Multrees to provide custody services. They are frequent winners of prestigious industry awards.

Multrees are a significant provider of custody and administration services to UK banks, wealth managers and family offices. They currently support over £16bn of assets, with a team-based wholly onshore, across two sites: London and Edinburgh. As a specialist custodian (rather than a firm that also carries out investment activities of its own), Multrees have an extremely low-risk business model. The entire organisation is structured so that everybody, from the CEO down, is solely focused on ensuring a safe environment to hold client assets, without the distraction of additional business lines. They are regulated (like Saltus) by the FCA.

Saltus carries out regular due diligence visits and reviews to ensure that we continue to be 100% happy with the service Multrees provide and believe that this model ensures that your assets are extremely well protected.

Who can see my holdings?

To provide effective recommendations, all household account information will be considered to be interconnected and, as such, you grant us permission to share information with any other clients within the household. Should you wish us to review your information on an individual basis, please advise us and we will separate parties into separate household accounts.

How are Saltus and Multrees regulated and cash protected?

Multrees have a direct contractual link with all of Saltus’ clients to provide custody and settlement services. In the event of Saltus’s insolvency, the assets would not be accessible to an administrator or receiver to reimburse them for the work involved. One of the reasons for using a segregated custodian is to ensure that, in the highly unlikely event of Saltus’ insolvency assets could quickly be accessed by clients.

Multrees are regulated by the FCA and specialise wholly in providing custody and administration services. All Multrees cash balances are guaranteed by the bank guarantee scheme, under the Financial Services Compensation Scheme rules. There has never been an instance in which a UK custodian insolvency has resulted in any loss of client assets.

What if I have a question not covered in this list?

If you have any questions please feel free to email [email protected] or contact us on 0207 292 7171.

Get to know us...

Get in touch...

Gia Powell