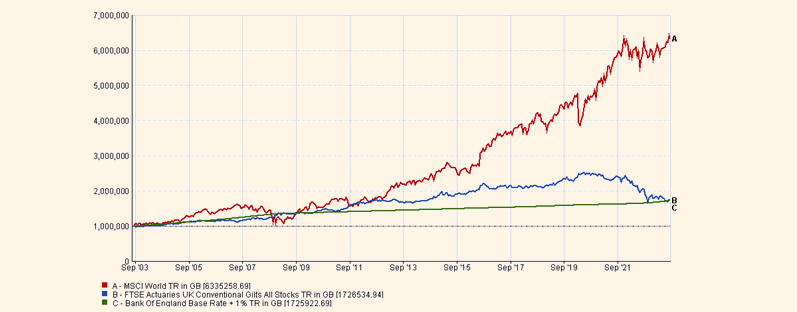

Albert Einstein once famously quoted ‘compound interest is the eighth wonder of the world. He who understands it, earns it…He who doesn’t, pays it’.[1]

I’m not here to say that one of the most influential physicists and Nobel prize winners was wrong, but rather clarify his message. Compound interest, in combination with great financial planning, is the true eighth wonder of the world.

Establishing your financial goals

Before starting the conversation of how to plan better for retirement, we need to establish what the end goal, or goals, actually look like. For some, this may be looking to afford a certain holiday every year or being able to pass wealth to future generations. For others, it may just be maintaining their standard of living in retirement. Everyone’s goals look different as no retirement is the same. Although, as a young professional it may feel like retirement is too far away to think about, having an idea of what you want from retirement can dramatically help a financial planner in devising a route ahead.