The Sage of Omaha and Mrs Watanabe are two names not typically associated with each other. However, Warren Buffett and the symbolic Japanese retail investor are both causing a stir in Japan with their actions and opinions as Japan has moved to the forefront of investors’ minds.

The fourth largest economy in the world is undergoing generational shifts in momentum. The central bank – the Bank of Japan (BoJ) – having pioneered ultra-loose monetary policy is now tightening policy whilst the rest of the world starts to loosen theirs. The currency – the Japanese yen – has weakened to levels not seen since the 1960s. Inflation has returned to the national psyche following a three-decade hiatus. And the stock market has been one of the standout performers of the last two years having spent a number of years going nowhere. Add in political upheaval, a rapidly ageing population, regional geopolitics, and corporate reform, and you have a mixed picture full of opportunities and risks.

In this article we will explore the drivers of these changes, as well as some of the opportunities and risks that investors should be aware of.

Returning from the economic wilderness

Watch our webinar

Active vs Passive investing – is passive better than active managementIn conversation with Michael Stimpson and Jordan Gillies

Japan’s lost decades are said to have lasted from around 1991 to 2021. This thirty year period was characterised by persistently low inflation and growth which was occasionally punctured by recessions. The start of the lost decades was brought on by the spectacular collapse of the asset bubble in the late 1980s. These insipid years were made worse by natural disasters, unsuitable monetary and fiscal policy, and demographic challenges. [1]

The tide started to turn in the late 2010s, but then when Japan reopened post-Covid these trends became embedded and the turnaround has been remarkable since then. Nominal GDP growth averaged 3.5% in 2022 and 2023, more than double the rate of growth between 2013-2019, and far above the average during the lost decades when nominal annual growth was flat to negative. [2]

Inflation has become a hot topic of conversation again. BoJ governor Kazuo Ueda when asked if he had felt the impact of inflation said he could no longer buy a lunchbox at his university convenience store with a single ¥500 (£2.70) coin. For others, the reality hit home when the price of everyday staples like chocolate bars, chicken nuggets, and sukiyaki sauce rose for the first time ever, and subway fares were increased for the first time in 30 years.[3] To put the recent rise in perspective, Japan’s headline consumer price index has risen by 2% or more for 27 consecutive months to July 2024[4], whilst in the preceding 30 years, headline inflation was at or over 2% for 27 months in total.

The rising cost of living and deepening labour shortages have resulted in the biggest pay rises since the start of the lost decades. Wages are growing at a rate meaningfully above inflation which is contributing to consumer strength. The shunto spring wage negotiations saw large companies give their unionised workers an average wage increase of over 5%,the biggest rise since 1992.[5]

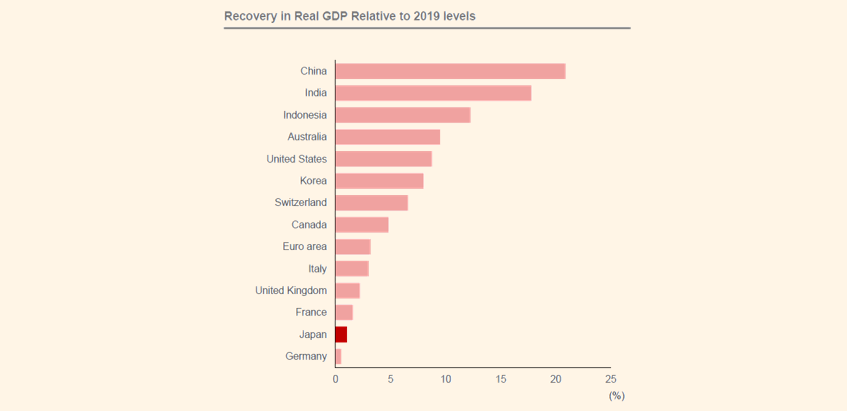

There may be more good news to come. Japan is positioned in the early stages of a recovery relative to other countries as the chart below shows. Real GDP remains only slightly above pre-pandemic levels so there is still plenty of room for Japan to catch up, especially when considering that real wages are rising, corporates are profitable and spending, and unemployment remains low.

(Right) Change from 2019 average for Oct.-Dec. 2023, partly for Jul.-Sep. 2023.

Source: Nomura Asset Management based on Cabinet Office and Bank of Japan data.

Alphabet soup

Japan is the most indebted country in the world as measured by debt to GDP [6]. This is partly as a result of the lost decades, as GDP stagnated, but also due to unconventional government and central bank policy responses that were enacted in order to stimulate the economy.

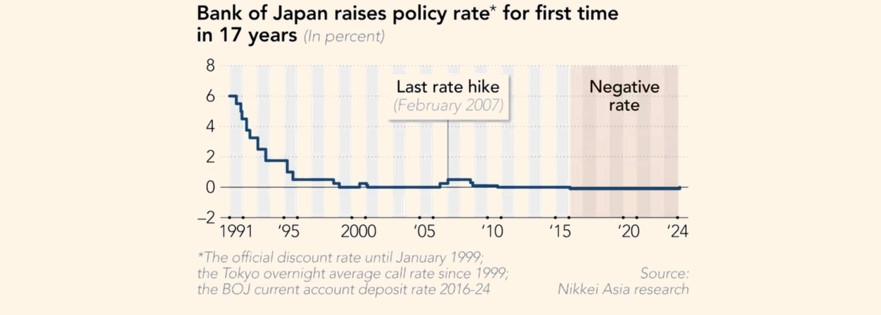

The BoJ are seen as pioneers of ultra-loose monetary policy and gave us a whole host of new acronyms. They were the first central bank to implement official quantitative easing (QE) in 2001. This was followed by quantitative and qualitative easing (QQE) in 2013 and then QQE2 in 2014. None of these succeeded in boosting the economy, so in 2016 the BoJ set a negative interest rate policy (NIRP)[7][8]. Rates then stayed negative until March 2024. They also implemented Yield Curve Control (YCC) in 2016 which sought to cap bond yields in an attempt to encourage borrowing and spending.[9] These ultra-loose monetary policies were met with ever more government borrowing and spending to try to prop up the economy, which meant the debt burden ballooned.

Japan was not immune to the post-Covid growth and inflation boom, but the BoJ were much slower to put the brakes on relative to other central banks. Whereas the US Federal Reserve started raising interest rates in March 2022, the BoJ waited until March 2024. Why did they wait? The scars from the lost decades were still fresh and they didn’t want to risk prematurely choking off the nascent recovery. [10][11]

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

The battle for the yen

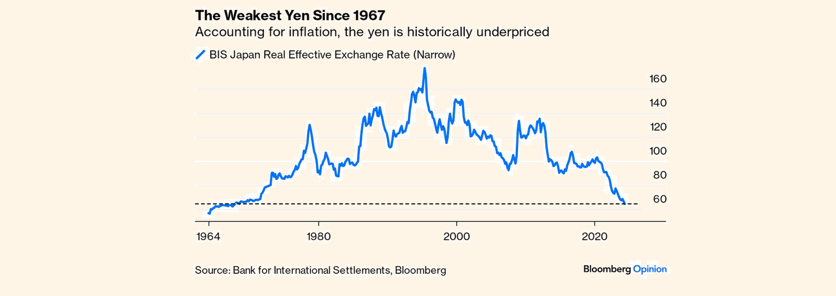

As developed market central banks put through rapid rate hikes whilst the BoJ stood still, the Japanese yen plummeted. The yen weakened to levels last seen in 1967 after accounting for inflation.

This weakness was seen as an opportunity for some, and a threat to others. Donald Trump has repeated his calls of currency manipulation against Japan, as a stronger US dollar and a weaker yen make Japanese exports far more competitive. Japanese residents also voiced their annoyance with an increase in imported inflation, and an influx of tourists taking advantage of the cheaper currency. Eventually the Ministry of Finance and the BoJ intervened, verbally and through market operations, but without the interest rate gap narrowing these actions were fruitless.

One group of investors saw this historic weakness as an opportunity. The carry trade returned as a popular strategy amongst speculators. This is a strategy in which an investor borrows money in Japan with a low interest rate, and then invests this money in a market with a higher return. The Mexican Peso for example has been a popular destination for carry traders. When the yen is falling the carry trader is benefitting from both the currency moves and the higher yield. Given the recent success of this trade, speculators have been using leverage to enter into this trade in size.

Then in July 2024 the BoJ surprised the market with a hawkish decision to increase the base rate to 0.25%, which coincided with interest rates falling elsewhere. The yen duly strengthened, which hit the carry trade, with leverage exacerbating the losses. The carry traders headed for the exit in unison, causing the yen to spike even higher and rumbling other markets in the process.

This episode shows that after so many years of ultra-loose monetary policy in Japan, and the associated distortions that have built up, it will be an uphill battle to restore normality, and we can expect more volatility on the way.

A governance revolution

On the face of it, a Canadian retail chain launching a $38.5bn takeover bid for a Japanese retail chain may not make the headline news. However, this could be the largest ever foreign acquisition of a Japanese company and is a test case for the ongoing corporate governance reform. [12] The company in question is Seven & i which is being bid for by Canadian firm Alimentation Couche-Tard. Seven & i have rejected the offer for now, but there is still life in the deal.

The fact that Seven & i could even think about selling was unheard of a few years ago, but Japan’s corporates are slowly changing their ways. Corporate governance reforms were a key pillar of Shinzo Abe’s ‘Abenomics’ in 2012, and this has had tangible results. Between 2013 and 2023 the number of mergers and acquisitions involving Japanese firms doubled.

Source: The Economist Japan’s sleepy companies still need more reform (economist.com)

Networks of cross shareholdings between Japanese companies – which were once used as a way to reinforce relationships and defend against hostile takeovers – are now being unwound as companies must be able to justify the reason for them. Investor activism which had been almost non-existent has started to pick up too, and is being bolstered by recent successes.

Source: The Economist Japan’s sleepy companies still need more reform (economist.com)

There is still a long way to go, which is why Japanese company valuations are still relatively low. The average price to book ratio is just 1.5 times, which compares to 2.1 for European companies and 5 for US companies, with half of the Japanese market having a price to book ratio below one, meaning a company’s assets would be worth more if they were sold off separately.

The Tokyo Stock Exchange (TSE) has been taking notice of these low valuations and has enacted reforms with the explicit aim to increase Japanese company valuations. The TSE requested that all companies listed on the Prime and Standard markets take “action to implement management that is conscious of cost of capital and stock price”, with an emphasis on companies with a price to book ratio less than one. The TSE has also mandated all listed firms to disclose the actions they are taking to improve capital efficiency and boost their valuations by March 2025. [13]

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

Putting it all together

Global investors have taken stock of these changes in momentum. The Japanese stock market has been one of the best performing over the last two years. Warren Buffett, unsurprisingly, was early to the party. In 2020 he announced Berkshire Hathaway had acquired stakes of around 5% in five ‘old economy’ Japanese trading houses. In 2023 he raised his stakes to an average of 8.5%, and earlier this year stated that the shareholder-friendly policies of the trading houses were superior to those in the US. [14][15] When the world’s most famous value investor speaks, the market listens. The stock market hit all-time highs a couple of months after the comments.

Mrs Watanabe – a catch-all term for Japanese retail investors – is being ushered into the local stock market. Japanese retail investors have historically held the majority of their wealth in cash. The government recently revamped the rules around the tax-exempt Nippon Individual Savings Account (NISA), increasing the annual limits to encourage investment. Household wealth is estimated to be around $14tn, so even if there is a small increase in equity allocation from cash this could have an outsized impact on the domestic stock market. [16]

Although the Japanese stock market has been booming, foreign investors haven’t necessarily felt the full effects. If a foreign investor had held their Japanese stocks in yen, the shine would have been taken off by the weakening currency.

Saltus have had a relatively high weighting to Japanese equities over the last five years, and we started increasing our allocation in the second half of 2022 given many of the reasons mentioned in this article. Due to the violent moves in the yen over that period, we have been actively managing which currency we hold these equity positions in.

The chart below shows the yen/sterling exchange rate, and we have noted where we decided to alter the holding currency of our Japanese positions. Until the start of 2023, all of our Japanese equity exposure was hedged back to sterling as it was clear the BoJ weren’t following other central banks in tightening policy, which was placing downward pressure on the yen. Then, as the yen kept falling, but inflation and growth in Japan kept rising, we thought there may actually be some scope for the BoJ to consider tightening. We slowly started unhedging our Japanese equity exposure in the first half of 2023, and from late 2023 (the dotted line forward) we took the hedge off completely. In hindsight this was a little too early but has since come good. This highlights the value that can be added from actively managing currency exposure when making foreign investments.

Source: Saltus & Bloomberg

As well as considering the holding currency of our Japanese equities, we also assess the style. Our current exposure is held through two funds, Nomura Japan Strategic Value Fund (more information on this fund can be found in this update Asset Allocation Update October 2023 | Saltus), and Nomura Japan Small Cap Equity Fund.

We initiated a position in the small cap fund in February 2024 and have been building the position since. This fund invests in smaller companies which we believe are more exposed to the corporate reforms, capital efficiency improvements and the domestic economic revival. They are also protected from a strengthening yen as they tend to be less export focused and more domestically focused. They are cheaper on the whole too. We have been funding these purchases from the Nomura Japan Strategic Value Fund following good performance, and the greater risks to larger companies from a stronger yen.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

Article sources

- [1] “Following Three Lost Decades, Is Japan at a Turning Point?,” Abrdn, August 22, 2024.

- [2] “Positive Outlook for Japan Stocks | Morgan Stanley,” Morgan Stanley, n.d.

- [3] “Subscribe to Read,” Financial Times, n.d.

- [4] Trading economics, “Japan Inflation Rate,” n.d.

- [5] Statista, “Wage Increase Negotiated at Spring Wage Offensive (Shunto) Japan 1989-2024,” May 14, 2024.

- [6] “Japan - National Debt 2029 | Statista,” Statista, July 4, 2024.

- [7] Roman Matousek et al., “The Effectiveness of Quantitative Easing: Evidence From Japan,” Journal of International Money and Finance 99 (August 12, 2019): 102068.

- [8] Sean Ross, “The Diminishing Effects of Japan'S Quantitative Easing,” Investopedia, August 24, 2023.

- [9] “Bank of Japan: Japan Yield Curve Control Regime,” Columbia SIPA, n.d.

- [10] “Japan Ends Era of Negative Interest Rates. Here’s Why,” World Economic Forum, September 10, 2024.

- [11] Russell Burns, “The Bank of Japan Ended Its Negative Interest Rate Policy,” Finimize, March 19, 2024.

- [12] The Economist, “Japan’s Sleepy Companies Still Need More Reform,” The Economist, September 9, 2024.

- [13] Lucy Ray, “Japanese Corporate Governance Reform (1Q24) - Pzena Investment Management,” Pzena Investment Management, April 18, 2024.

- [14] William Pesek, “Warren Buffett Just Made Bank of Japan’s Job Even Harder,” Forbes, March 4, 2024.

- [15] “Tempted by Japan’s Booming Market? Be Like Warren Buffett,” WSJ, July 2024.

- [16] “What is Japan’s NISA tax-free investment scheme?,” Reuters, November 2023.

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

The views expressed in this article are those of the Saltus Asset Management team. These typically relate to the core Saltus portfolios. We aim to implement our views across all Saltus strategies, but we must work within each portfolio’s specific objectives and restrictions. This means our views can be implemented more comprehensively in some mandates than others. If your funds are not within a Saltus portfolio and you would like more information, please get in touch with your adviser. Saltus Asset Management is a trading name of Saltus Partners LLP which is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

Related blog posts

About Saltus?

Find out more about our award-winning wealth management services…

Winner

Investment Performance: Cautious Portfolios

Winner

Top 100 Fund Selectors 2024

Winner

Best Places to Work 2024

Winner

Best Financial Advisers to Work For

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate