Investment conditions

Global growth remains robust, with positive GDP growth rates across the board in Q3. Again, the US leads the way from a strong growth and low unemployment perspective. China’s GDP growth remains positive, but it is running well below the government’s target of 5% for 2024 as a whole.

Globally inflation rates, whilst still low, are picking back up. At the latest reading, US inflation increased from 2.6% to 2.7%, 2% to 2.3% in the Eurozone, and 1.7% to 2.3% in the UK. Although still at relatively low levels, these growing numbers highlight the difficulty of ‘the last mile’ in terms of seeing inflation sustainably at or below target levels.

Unemployment remains near historic lows in the developed economies. This is supporting healthy wage growth, which combined with lower inflation is bolstering the consumer by increasing purchasing power. A buoyant consumer has been a key pillar of economic growth and earnings growth in this cycle.

Third quarter earnings mirrored the economic growth picture. US earnings were robust, with revenue and earnings growth beating expectations. It was a more muted story in Europe and the UK, with positive and negative surprises offsetting each other. Global earnings growth is set to be near 10% in 2024 as a whole, rising to 12.3% in 2025, with the US and Emerging Markets (EM) being the bright spots at 14.3% and 14.5% respectively. The UK and Europe are the laggards, with 6.2% and 7.8% expected earnings growth for 2025. This is reflected in valuations with the US being overvalued relative to its long term average, and the UK and Europe looking undervalued.

Central banks continue their rate cutting path. The US Fed, the Bank of England and the European Central Bank (ECB) all cut their base rate by 0.25% at their most recent meetings, to 4.75% (upper band), 4.75%, and 3.0% respectively. In the US, expectations for rate cuts in 2025 have been tempered following the presidential election.

Market Themes

Trump Returns

November was dominated by the US presidential election and the resultant clean sweep for Donald Trump. Since then, investors have been trying to foresee the impacts this will have on financial markets. The consensus is for Trump’s ‘America-First’ agenda to target lower taxation, deregulation, trade tariffs and lower energy prices, with a view to bringing more manufacturing and industrial activity back onshore. His main messages during the election campaign were to put an end to inflation, and grow the economy, and he has made reference to the US stock market as a gauge of his success.

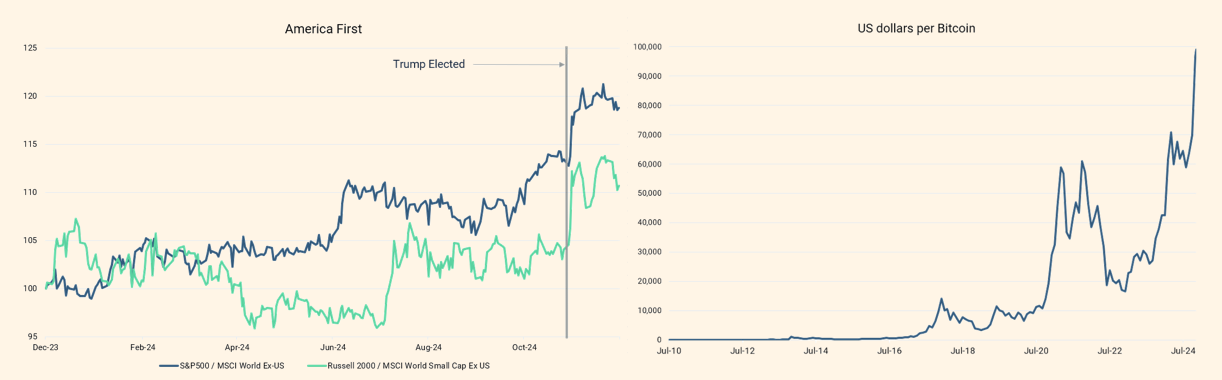

In the month since the election, one of the main beneficiaries has been US stocks, and especially smaller US companies given their greater domestic focus, meaning they should benefit more from tax cuts and reshoring of production. The blue line in the first chart below shows the performance of the US stock market relative to the global stock market excluding the US. The green line shows the US small companies index relative to the global small companies index excluding the US. We have marked the election date on there. The other beneficiary has been Bitcoin, which recently surpassed $100,000 for the first time. Trump has expressed support for the cryptocurrency market and has picked a crypto advocate – Paul Atkins – to head up the US Securities & Exchange Commission.

Source: Saltus/Bloomberg

Questions remain over the path of interest rates, given Trump’s policies have the potential to be inflationary. US treasury yields and the US dollar moved up sharply in the aftermath of the election, but both have now moved back to where they were prior to the election in November. The message may be that the market expects Trump’s bark to be worse than his bite, and some of his rhetoric may be watered down before he takes the reins in January 2025.

European Turmoil

If the return of Trump has bought four years of political stability, at least in terms of who is in power, Europe is experiencing the opposite. Economic growth in Europe has been slowing for a number of quarters now, with Germany leading the way down given the economy’s dependence on manufacturing and autos especially. To rub salt in the wounds, the governments of France and Germany – Europe’s two largest economies – have collapsed in the last month.

First to go was Olaf Scholz, the German Chancellor, whose coalition government fell after he sacked his finance minister following a dispute about next year’s budget. This has paved the way to a federal election set for 23 February 2025, seven months earlier than planned. Then in France, a no-confidence vote toppled the Prime Minister Michel Barnier after he proposed an unpopular deficit-reducing budget. Under the constitution, the president cannot call new legislative elections until July 2025, and so policy drift is likely to carry on for many months.

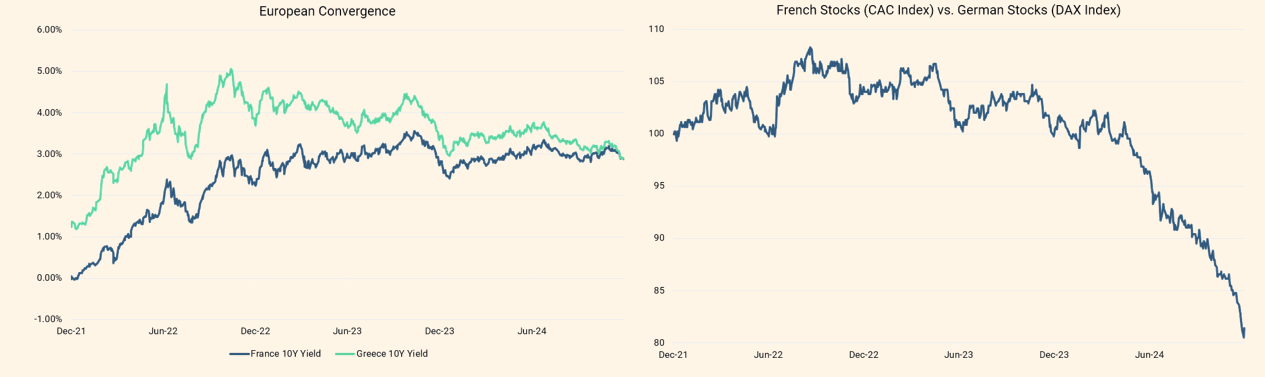

These political ructions come at an awkward time for Europe, with the uncertainty over policy that Trump brings. Europe has found itself in the middle of US and China tensions and will likely have to increase defence spending over the coming years. In both France and Germany, fiscal rules are being reconsidered which likely points to more stimulative fiscal policy on the continent. Now though, the turmoil is weighing on France’s stock and bond markets, with yields on the government’s debt yielding the same as Greece’s. If political stability and government spending do materialise in 2025 though, there could be an opportunity in unloved European assets.

Source: Saltus/Bloomberg

Views by asset class

Equities

There were no changes to the equity holdings.

The US remains our largest geographical exposure which the committee is comfortable with given the country’s economic prospects. We are aware there are large distortions in the US market, with a handful of AI-related technology companies trading at expensive levels. We want to avoid exposure here, and so we own the equal-weighted S&P500 index where each of the 500 companies are allocated a 0.2% weighting. This gives us exposure to the largest US companies but avoids the concentration risk in the market-weighted S&P500 index in which the largest seven companies account for around one-third of the index. This holding is complemented with active US equity funds.

Elsewhere in the equity book, the committee has a positive view on Japanese equities for reasons listed here (Japan’s Economic Renaissance | Saltus), and especially smaller Japanese companies given their domestic focus.

There was discussion on our positions in Asia ex-Japan and Emerging Market equities given the potential impacts of a Trump presidency. The obvious pain point is China given proposed trade tariffs. We have a low exposure to China and so most of the conversation centred around the impact of a potentially stronger US dollar and higher US interest rates leading to tighter financial conditions in Emerging Market economies. There was no action taken but it was flagged as an area to monitor.

Bonds

The committee decided to continue moving away from US government bonds, recycling the proceeds into global government bonds with a focus on Europe and the UK. The maturity-profile will also be reduced, moving from US long-dated bonds to more short and medium-dated non-US bonds, however overall, we do not want to change the interest rate sensitivity of the bond exposure.

This increase in non-US government bond exposure will be funded through both selling US long-dated government bonds, but also selling investment grade corporate bonds. The investment grade corporate bond market has performed well over of the last couple of years as money has flowed into the asset class. Valuations are now at record highs when measured by the excess yield they offer over equivalent government bonds, or the credit spread. Given the current valuations the committee decided that it was a good time to take profits to fund opportunities in the non-US government bond space.

The decision to reduce US government bond exposure was a continuation of the portfolio moves of the last six months. We have slowly been reducing US government bond exposure given concerns over the fiscal position of the US government, who are issuing record amounts of debt to fund a fiscal deficit that is almost 7% of GDP. With the election of Donald Trump, a reacceleration of growth and inflation could result in interest rates staying higher in the US, whereas in Europe and the UK, interest rates are likely to fall further in 2025 given lacklustre economic performance.

Alternatives and Currency

The committee decided to sell the broad commodity index fund and redeploy the proceeds into higher-conviction alternatives. The broad commodity index is made up of around 40% in energy, of which a large proportion is oil. We owned the commodity index as a hedge against growth and inflation surprising to the upside. This view has changed given the outlook for the energy sector in 2025. Trump has reiterated that he wants to see lower energy prices, and a large part of his election campaign rested on reducing inflation. Lower energy prices are an integral part of this. There are also question marks over a slowing ex-US economy, and the wavering discipline of members of the OPEC+ oil cartel, who may decide to produce more oil to maintain market share.

The proceeds from the sale of the broad commodity index will be used to increase our exposure to other uncorrelated alternative strategies where there is a higher conviction. Within our commodity bucket there is still direct exposure to copper. Supply constraints combined with an increase in future demand make the outlook attractive for the metal, and it will also act as a hedge if growth surprises to the upside, especially in China.

We still remain positive on gold and gold miners given the large central bank purchases that are taking place as countries try to reduce their dependence and reserve holdings of US dollars. Gold can also act as a good hedge in a geopolitical escalation, or a return of significant inflation.

We will always consider which currency we want to hold our foreign assets in. The default is to hedge back to the home currency if possible, unless we want to take an active position.

The committee decided to increase our exposure to the Japanese Yen, both out of Sterling cash, but also by reducing US Dollar exposure at the margin. The Japanese Yen should add to portfolio diversification and provide protection in a global market correction. The Japanese Yen has weakened considerably over the last few years given the Bank of Japan’s ultra-loose monetary policy. This has now changed with the Bank of Japan pivoting to tightening mode, whilst the rest of the world embarks on a rate cutting cycle. As interest rates converge between Japan and the rest of the world, the Japanese Yen could strengthen.

Summary of positioning

Below is a summary of our views for each asset class, from strongly negative (- -) to strongly positive (+ +).

Asset Class

| Asset class | -- | - | Neutral | + | ++ |

|---|---|---|---|---|---|

| Equities | X | ||||

| Government bonds | X | ||||

| Corporate bonds | X | ||||

| Alternatives | X | ||||

| Cash | X |

Asset Class Breakdown

| -- | - | Neutral | + | ++ | ||

|---|---|---|---|---|---|---|

| Equities | USA | X | ||||

| UK | X | |||||

| Europe | X | |||||

| Japan | X | |||||

| Asia ex-Japan | X | |||||

| Emerging markets | X | |||||

| Bonds | US Government | X | Non-US Government | X | ||

| Inflation-Linked Government | X | |||||

| Investment Grade Corporate | X | |||||

| High Yield Corporate | X | |||||

| Alternatives | Commodities | X | ||||

| Gold & Gold Miners | X | |||||

| Macro Hedge | X | |||||

| Market Neutral | X | |||||

| Other Alternatives | X | |||||

| Currency | Sterling | X | ||||

| US Dollar | X | |||||

| Euro | X | |||||

| Japanese Yen | X | |||||

| Emerging Markets | X |

Manager in focus: PGIM Jennison Global Equity Opportunities Fund

Summary

This fund is a relatively new addition to portfolios and it complements our current range of global equity managers by offering unique exposure to the secular growth theme, which focuses on long term trends like technology, demographics, and sustainability that drive persistent economic growth.

The team behind this fund have been focusing solely on higher growth equities for 25 years and have a remarkable track record of outperformance. The boutique nature of Jennison and a sole focus on higher growth equities has fostered a team of specialists that have identified multiple secular growth themes over time.

The team focuses solely on innovative and disruptive companies that exhibit strong and sustainable earnings growth, durable competitive advantages, and the ability to compound at high growth rates over time. They aim to find companies that are in their rapid expansion phase which allows them to potentially capture superior returns, but with a stringent focus on exiting at the right time, when growth is plateauing and the company is maturing.

Valuation is an important consideration in their investment process, however the primary focus is on growth potential which is estimated through extensive fundamental research.

PGIM, Jennison and the Team

Jennison Associates was founded in 1969 and is a wholly owned subsidiary of PGIM – the investment management business of Prudential Financial Inc (PFI) which is an American life insurance conglomerate with over $1tn of assets under management (AUM).

PGIM comprises a collection of boutique asset management brands, of which Jennison is one. Over 1,300 investment professionals fall under the PGIM umbrella, 75 of these are at Jennison, and Jennison’s AUM is around $200bn. The majority of these assets are invested in growth-focused equity strategies. Jennison operates as an independent company and has full autonomy over their investment philosophy and process. They have a low staff turnover.

The fund has been managed by Mark Baribeau and Thomas Davis since its inception in 2011. Rebecca Irwin joined the team as a fund manager in 2023. Baribeau started developing the fund’s investment process in 1999 at Loomis Sayles, joined by Davis in 2000. The managers are supported by a team of 11 career analysts, split by sector, who have an average tenure of 15 years with Jennison Associates and 21 years in equity research. The analyst sector split is skewed to higher growth sectors such as healthcare, technology, and consumer services, with the team only focusing on higher quality growth equities.

Philosophy

At its core, the team believes in active management and their ability to exploit growth opportunities. The team set the bar very high for investment opportunities, and will only invest in a small number of genuine growth companies. The team look to invest in companies which are experiencing early stage growth, or are at an inflection point in their growth cycle. They look for stocks with a diversified set of growth drivers and themes – something they believe will reduce the overall level of portfolio risk as the stocks will behave and move differently.

The team employ a rigorous fundamental research process to identify stocks which have the following attributes:

- Innovative and disruptive businesses driving structural shifts in their respective industries

- Defensible business models with significant barriers to entry

- Secular demand trends driven by superior product offerings

The different themes in the portfolio include cloud computing and infrastructure, food delivery, digital payments and technology-enabled direct-to-consumer businesses such as e-commerce platforms. The team have a conservative philosophy, preferring to sell out of a stock as a company approaches its slowing growth phase.

Process

The investment process for the fund has been refined and executed over multiple decades, so not only is there consistency across the team, but more importantly they have shown precision when it comes to identifying sustainable higher growth ideas. The team try not to think in terms of growth stocks, rather they think about growth themes which will play out over multiple years. They then choose the companies at the forefront of the themes.

The fund doesn’t invest in pre-revenue companies but will consider companies that are not yet profitable provided there is a clear roadmap to profitability over the next 3 years.

The team meet daily to discuss new and existing ideas in addition to holding a weekly meeting where best and worst performers are discussed. They will also hold monthly performance reviews of the underlying investments of this fund which run concurrently with writing commentaries. Sector analysts are responsible for the day-to-day research of their respective area and the team are in continual communication with each other.

The process is split into 5 stages:

- Idea Generation – ideas are generated in-house by the sector analysts. The team will use screens to reduce the investible universe from 5000 companies to around 300. Each analyst will not cover more than 20 companies at a time as they will undertake extensive fundamental analysis on these stocks. They will engage with industry experts to more fully understand new growth themes.

- Fundamental Research – from the 300 stocks, the team will seek companies with distinctive business models that exhibit sustainable competitive advantages and high barriers to entry. They also look for catalysts and superior financial performance. A strong balance sheet is preferred, and meeting management is a crucial part of their research process.

- Valuation – the team seeks to find underestimated growth opportunities without overpaying for that growth potential. A variety of valuation methods are employed depending on the stage of each company’s growth trajectory.

- Portfolio Construction – there are no sector or country limits. Position sizes are usually between 1.5% – 8% but can go to a maximum of 10%. The size of the position is a function of conviction around the idea. As the team are investing significantly in a handful of themes, a lot of diligence is taken when considering the relationship between each of the investments so the portfolio doesn’t become too risky.

- Sell Discipline – the key factor in deciding whether to sell the investment is whether it has reached the end of its high-growth phase. The sell discipline is designed to ensure companies are sold before growth matures and valuations start to fall.

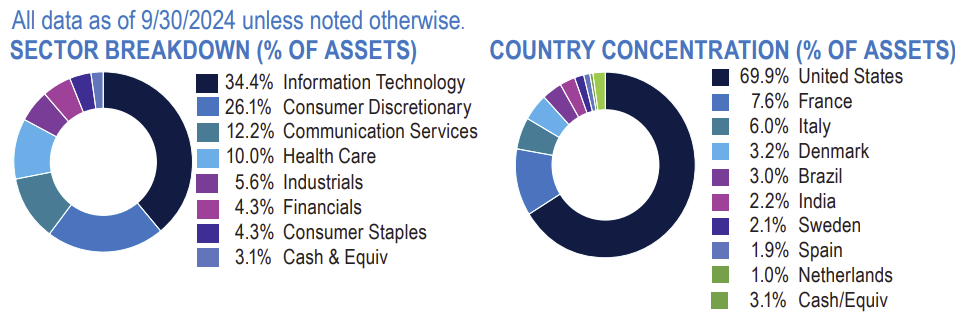

Portfolio and performance

The portfolio is mostly focused on developed market high quality and high growth equities, which will predominantly be large companies. There is an emphasis on technology and consumer discretionary sectors given the capital-light and innovative characteristics in these sectors. There are some sectors which have not yet featured in the fund such as energy and utilities. Given the growth bias of the fund, the fund’s multiple is meaningfully higher than the market.

The fund is currently invested 70% in the US and 22% in Europe. However the team have a global remit and historically have had as much as 20% invested in Emerging Markets. There is a bias towards higher quality companies with low financial leverage. Liquidity is very high as the portfolio includes some of the largest and most traded companies. The top five holdings are Apple, Microsoft, Nvidia, Meta and MercadoLibre. The top ten holdings usually make up 40%-50% of the fund, and the average position size is 3%.

Since the inception of the European version of the fund in 2017, it has achieved top quartile performance versus peers and has strongly outperformed the global stock market. A high proportion of this outperformance has come from stock selection. 2020 was a particularly good year, with the fund up 67%. The fund will likely perform well towards the middle and end of the economic cycle when growth is scarce and interest rates are falling. When there is strong cyclical performance, the fund will likely underperform the market.

Saltus Rationale

This fund gives portfolios targeted access to the secular growth theme in equity markets, but with a management team that have evidenced their ability to outperform by selecting the best stocks over many decades. They are growth equity specialists with a huge amount of experience, a proven process, and a disciplined approach to risk management and selling stocks.

There is an element of valuation risk with this fund given that the growth theme is expensive. Whilst the team are conscious of valuation, it doesn’t lead the process as they want to identify companies that are in the early stages of rapid growth, and will grow to justify and increase current valuations. The team monitor the relationship between the stocks in the portfolio to ensure that the exposures are diversified, which should reduce portfolio risk.

The fund sits within our global equities bucket, which includes managers with a value bias, or with a core approach of value and growth, and so the fund provides a diversifier in the portfolio rather than an addition to a style.

Saltus use this fund as part of a diversified portfolio. This is not a recommendation to invest in this fund. Saltus will not be liable for any losses incurred as a result of investing in this fund.

Asset Allocation Committee

The committee consists of several senior members of the investment team, all partners, who invest their own money alongside clients. The committee consists of:

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

The views expressed in this article are those of the Saltus Asset Management team. These typically relate to the core Saltus portfolios. We aim to implement our views across all Saltus strategies, but we must work within each portfolio’s specific objectives and restrictions. This means our views can be implemented more comprehensively in some mandates than others. If your funds are not within a Saltus portfolio and you would like more information, please get in touch with your adviser. Saltus Asset Management is a trading name of Saltus Partners LLP which is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.