Request a call back...

Contact us today to discuss how we can help you.

Alternatively, you can call us on 01489 663700 (Open Mon-Fri, 9am – 5pm)

Contact us today to discuss how we can help you…

Let us know how we can help…

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate

At our London office, we focus on understanding you and your life goals—not just your finances. Our experienced financial advisers know the ins and outs of wealth management and provide practical, tailored advice.

Whether you’re looking to grow your assets, plan for retirement, or protect your legacy, our London wealth management team can guide you through the process.

"Our London team understands our clients' unique financial goals and brings a wealth of experience in wealth management, enabling us to provide tailored and insightful advice. We take pride in building lasting relationships and guiding our clients toward financial success."

Craig Harrison, Chartered Financial Planner and Partner, based in London

"At our London office, we take the time to understand your life goals beyond just your finances, ensuring a comprehensive approach to your wealth management needs."

Alex Pugh, Chartered Financial Planner, based in London

"Our London team is dedicated to delivering personalised wealth management solutions, helping you navigate the complexities of financial planning with confidence."

Gianpaolo Mantini, Chartered Financial Planner and Partner, based in London

Saltus Financial Planning is a ‘Chartered’ financial planning firm. It is a recognition provided to only a small number of firms that are at the forefront of our profession.

Achieving Chartered status means that we have met the highest standards for technical competence in the advice we provide to clients. It also demonstrates our dedication to continued professional development and shows that our clients are at the heart of everything we do.

We are specialists in wealth management and have been supporting our clients with their finances for over 20 years. Our team consists of some of the most highly qualified advisers in the country.

We’ll explore your objectives and requirements in detail, taking everything into account to create a personalised and bespoke financial plan.

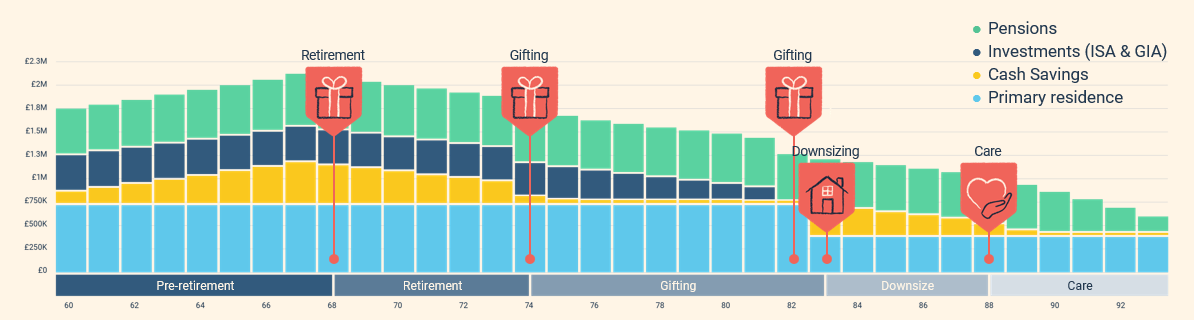

We create a personalised financial road map for our clients. Prior to investing, we can provide a clear recommendation on areas such as how much you need to save towards retirement, pension consolidation, how much income you can draw from your investments, minimising your tax burden, what return your investments need to generate to deliver your plan and how to pass on your wealth effectively.

We harness the latest and proprietary technology to provide our advice. This can help you visualise your finances and bring your plan to life.

Effective cashflow planning, for example, has the potential to be life changing. Your assets, liabilities, regular saving plan and financial goals can be input into cashflow modelling software. These can be overlayed with different assumptions, such as expected investment growth, to help establish if you have enough money to achieve all your goals.

Scroll to view full image

We provide a wide range of investment management solutions so we can find the one that best meets your needs, with the aim of delivering optimal risk-adjusted returns.

We’ll work around you, with the ability to hold meetings via video, at your home, at your workplace, or at one of our offices

Bus routes 14, 38, 19 and 23 all serve stops which are a walkable distance from the office.

The office can be accessed via London Underground or bus routes from all London terminals. Please refer to the map for nearest stations.

Black cabs can be hailed on the side of the road, or you can use apps such as Uber, Bolt or FREENOW.

When you arrive, please press the buzzer and reception will let you in. Let them know you are here to see Saltus, and they will let our team know you have arrived.

Please make your way to the 1st floor via the stairs or lift, where our London team will greet you.

There is a lift as you enter the building, which can take you to the 1st floor. There is also an accessible toilet within our office space. If needed, there is a refuge area in case of an emergency.

Please contact our team in advance if you require any assistance.

Unconstrained, multi-asset class investors with an award winning track record...

We work with individuals from all walks of life and have a diverse client list consisting of people from professional backgrounds (including senior executives, entrepreneurs, lawyers, accountants, consultants and others) and non-professional backgrounds alike.

We typically work with clients with £250,000 or more in investable assets.

This has to be one of the most common questions we are asked as financial planners. The reality is that everyone is different. We’ll take the time to analyse what you spend now, and how this may change in retirement to help provide you with a precise answer. We have written an article on the subject, if you’d like to find out more

We work in partnership with our clients and can take care of all your needs in one place, all supported by industry leading technology.

As well as surrounding you with a team of highly qualified individuals, we have our own platform, can provide the tax wrappers you require, source investment solutions from the wider market or from our award-winning asset management team, and review your protection needs to ensure your family are looked after should the worst happen.

Once you have contacted us, we’ll have an initial discussion to understand more about what you are trying to achieve and how your existing assets and investments are structured. We’ll then have some further meetings to garner an in-depth understanding of your requirements and provide you with a report that outlines our recommended financial plan.

There’s no charge for the initial steps. As our plans are bespoke to your objectives, charges will depend on what’s recommended to you. These will be outlined in full before you progress with us.

Contact us today to discuss how we can help you.

Alternatively, you can call us on 01489 663700 (Open Mon-Fri, 9am – 5pm)

Winner

Investment Performance: Cautious Portfolios

Winner

Top 100 Fund Selectors 2024

Winner

Best Places to Work 2024

Winner

Best Financial Advisers to Work For

Winner

Investment Performance: Cautious Portfolios

Winner

Top 100 Fund Selectors 2024

Winner

Best Places to Work 2024

Winner

Best Financial Advisers to Work For

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate

Saltus Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

Contact us today to discuss how we can help you.

Alternatively, you can call us on 01489 663700 (Open Mon-Fri, 9am – 5pm)