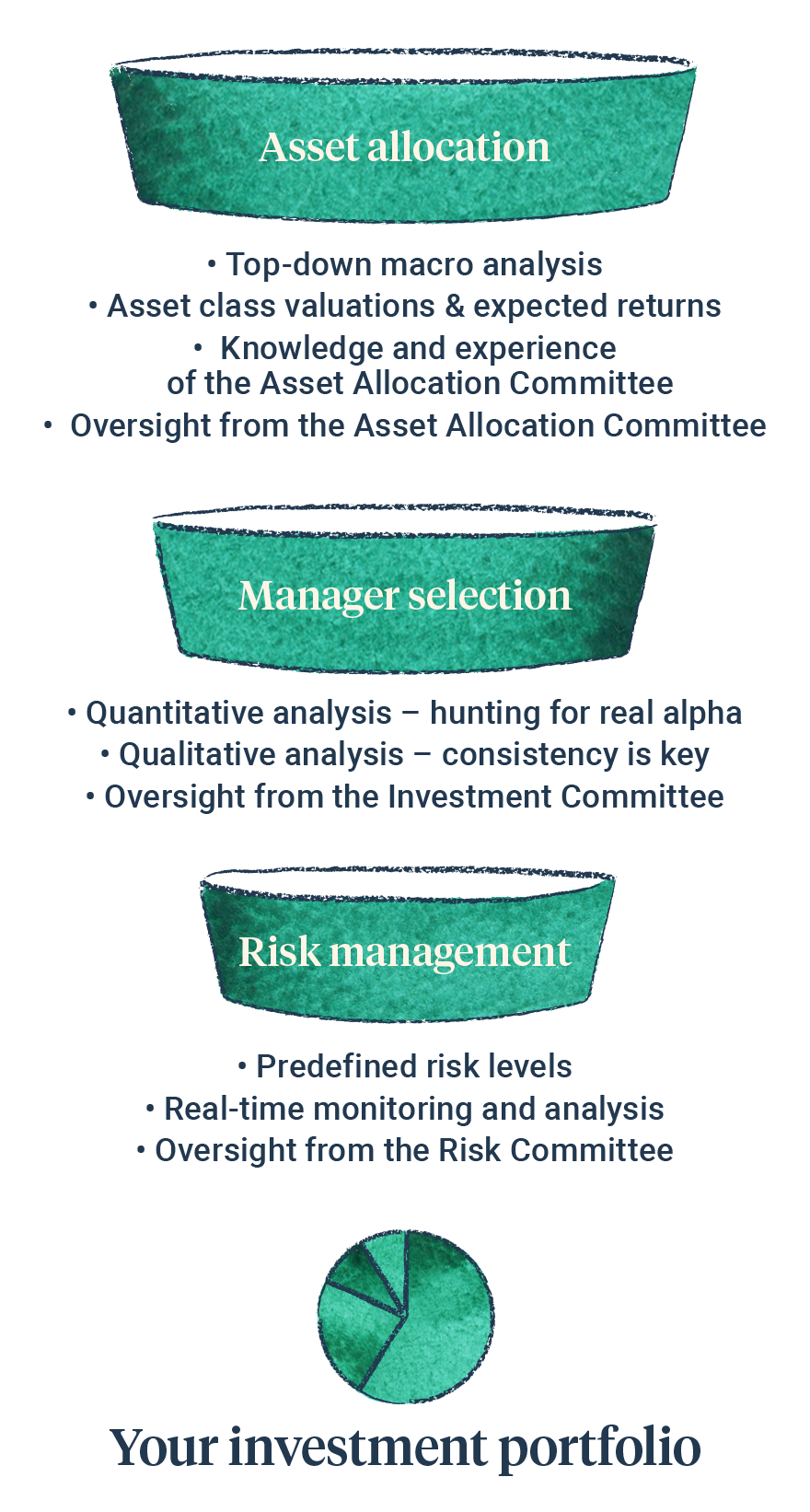

Investment conditions

Growth (economic)

The macroeconomic outlook is uncertain, with sharp swings in expectations as market participants adjust to new data. We see a slowdown in both world GDP and inflation, with many countries approaching technical recessions. The most recent data shows a small uptick in growth from strong activity in the US, and China re-opening its economy.

Interest rate & liquidity environment

Policy hawkishness is the main feature influencing markets. The central case is that inflation is peaking around now, presaging a peak in interest rates by year end or early 2023 which is being reflected in inverted yield curves. Central banks are reducing their balance sheets and market liquidity which makes policy much more restrictive than headline interest rates imply.

Valuations & earnings outlook

World equity valuations (P/E ratio) have fallen by 30% from their highs in 2021. But being only 2% lower than their 20-year median, aren’t cheap on aggregate. There are some areas that do look cheap, Europe and Japan for example. There is evidence that US corporate margins and earnings are beginning to come under pressure.

Sentiment / flows

Sentiment is very poor based on survey submissions yet in our opinion, actual investor positioning seems more ‘risk on’ with big institutional investors maintaining still high equity weightings. Perhaps the resilient earnings season is helping, and the idea that we may be near the peak in interest rates in the US.

Views by asset class

Equities

Data in the US shows its continued strength relative to most markets. Unemployment is very low. Consumer and company balance sheets remain strong, and earnings are holding up better than in many countries. They remain our largest absolute allocation in portfolios.

Within the US, smaller companies have been hit hard and are trading near all-time lows, significantly cheaper than the overall market. We think they could generate excess returns going forward and have tilted portfolios in this direction.

Japan has very low unemployment (2.6%), and its economy is strengthening. These factors, coupled with a significant fall in the yen, have resulted in large increases in reported earnings for Japanese companies, yet its stock market continues to trade at depressed levels. We have reconfirmed our overweight to Japan, and may add more pending increased clarity on valuations, assessment of forward margins, sentiment, and investor positioning, and above all an identification of clear catalysts for a real pick up in investor (both domestic and foreign) interest.

With the business cycle turning, costs increasing, and earnings beginning to come under pressure, last year we tilted our portfolios towards companies scoring high in quality metrics such as strong balance sheets, low financial leverage, high returns on equity, and the ability to pass on price increases to consumers. These companies are less likely to suffer earnings downgrades. Because of the outlook, we maintained our tilt towards quality factors in equities.

Government bonds

We invested in short-dated US Treasuries to add some protection in the volatility, and position for a slowdown, which has worked out well. We decided to increase our exposure to medium-dated US Treasuries to increase recession protection.

Corporate bonds

Investment grade and high yield bonds are beginning to look attractive at current yields. We are waiting for a better entry point having anticipated a sell off earlier this year as we are concerned about recession risks. We maintained our very low exposure.

Alternatives

Alternative asset classes can provide protection during market falls, with returns not correlated to the rest of the portfolio. For this reason, we maintain our strongly positive view on the asset class.

We are positive on macro hedge funds which typically do well in volatile environments.

We invested in broad commodity exposure to benefit from rising commodity prices. We recently halved this position, banking significant profits. We chose to further reduce the position in favour of an investment in copper. We expect demand for copper to increase dramatically due to the energy transition and limited supply. We recognise this is a longer-term strategic opportunity that would be vulnerable in the short term to a deep recession.

Overall, the environment is characterised by high uncertainty and rising recession risk so we remain generally cautious but we are prepared to be contrarian and take advantage of volatility as markets oscillate between fear of further central bank tightening causing a recession and seeking opportunity in the next recovery cycle.

Summary of positioning

Below is a summary of our views for each asset class, from strongly negative (- -) to strongly positive (+ +). Arrows indicate decisions made at the most recent asset allocation committee meeting.

Asset Class

| Asset class | -- | - | Neutral | + | ++ |

|---|---|---|---|---|---|

| Equities | X | ||||

| Government bonds | X | ||||

| Corporate bonds | X | ||||

| Alternatives | X | ||||

| Cash | X |

Asset Class Breakdown

| -- | - | Neutral | + | ++ | ||

|---|---|---|---|---|---|---|

| Equities | USA | X | ||||

| UK | X | |||||

| Europe | X | |||||

| Japan | X | |||||

| Asia ex-Japan | X | |||||

| Emerging markets | X | |||||

| Bonds | Government | X | ||||

| Index-linked | X | |||||

| Investment grade | X | |||||

| High yield | X | |||||

| Emerging market | X | |||||

| Convertibles | X | |||||

| Structured credit | X | |||||

| Alternatives | Commodities, gold + miners | X | ||||

| Macro hedge + other alts | X |

Investment Committee Q&A

We’ve just seen a strong rally in many stock markets. Do you think the worst has now passed for stocks? Or could there be more pain ahead?

It all depends on the inflation outlook. Risk assets have recovered from a low on 16th June in the belief that markets can see through this Federal Reserve rate hiking cycle as inflation is anticipated to peak later this year and gradually fall back towards central banks’ 2% targets.

It must be a difficult time to make asset allocation decisions, what are the key variables you are watching?

As I have observed before it’s always difficult but the current period is particularly tricky as both bonds and equities sold off together. Normally bonds rally when equities sell off. This is evidenced in the performance of a ‘typical’ industry balanced portfolio of 60/40 equities/bonds that has delivered the worst twelve month return for over 90 years. Our investment process has an established framework of assessing: macro, valuations and technicals i.e investor positioning and flows. More recently we have added an assessment of liquidity conditions. At this time we are very focussed on central bank policy and yield curves, inflation and corporate pricing power.

How likely are we to return to the Great Inflation (and associated interest rate) conditions of the 70s and 80s?

We will only get a return to 1970’s style inflation if we get a wage/price spiral developing AND central banks ‘accommodate’ through provision of excessive liquidity as described by the monetarist school of economics. There are some signs of the former developing in the US, which we are monitoring closely. Unit labour costs, for example, are up 9.5% y-o-y and a majority of businesses are looking to raise prices. The key though is that Federal Reserve monetary policy is much tighter than implied by the headline Fed Funds rate.

The bond market is telling us that both inflation and interest rates will fall next year. Do you think this is justified? What happens if the market is wrong?

The two are particularly closely linked. In this sense this period looks much more like a typical post 1945 cycle when central banks tightened to head off inflation invariably inducing a recession. We have become used to recent decades of ‘The Great Moderation’ and the Greenspan ‘put’ when the Federal Reserve loosened liquidity at the first signs of distress and inflation was subdued largely due to the emergence of China as a source of deflation in tradeable goods. We still think there is a risk of the Fed having to tighten further to head off inflation. So a risk of market complacency.

US corporate earnings appear to be holding up ok. Are you surprised by this? Do you think it will continue?

Yes, earnings and forward earnings estimates have held up very well but are starting to come down albeit slightly. The falls in equities have all been about price/earnings contraction which peaked in the mid-20s for the S&P forward earnings and fell to 15.5 x in mid-June. The reason that earnings have been so relatively strong is many quoted companies have been able to pass on higher input cost increases. In anticipation of this happening we increased weightings last year in quality companies better able to maintain margins which has been helpful.

Some assets have been hit hard this year. Do any of these now look attractive?

‘Growth’ style equities have been hit particularly hard as they are ‘long duration’ assets with earnings often well into the future. Equities with low expectations, typically ‘value’ equities, and companies seeing higher profits from higher commodity prices have performed well. If this is a relatively shallow slowdown/recession then the growth equities in areas like technology, healthcare, the green transition are attractively priced. If it is a deep recession with associated financial system distress then they will resume the falls in prices seen earlier this year. We do like, however, smaller companies particularly in the US which are looking very attractively valued.

There have been some big moves in currency markets, why is that? And how has that affected portfolios?What is your view on China? Is it investable right now?

It has all been about US $ strength. Although challenged by China the US is the World’s only super-power that controls the World’s financial system and in the Ukraine war and associated geopolitical struggle the US is very prepared to use these levers. There have been huge capital inflows into the US partly to reflect these strengths but also capital flight from regimes where the rule of law is poor and the fact that the US Fed was the first major central bank to raise interest rates. In addition, the US is a remarkably resilient, adaptable capitalist economy with corporations that have a tremendous record of productivity improvement and innovation. The yen has been particularly weak and we are partly reducing our successful hedges here.

Regarding natural gas, are you worried about what will happen in the UK and Europe as we head into winter?

Europe is particularly vulnerable, and US self-sufficiency just adds to the US$’s appeal. There has to be a high probability Russia will turn off the gas taps which will make it a very difficult winter for households and businesses particularly in Germany and Italy. Enormous efforts are being made, however, to find alternative supplies and improve the LNG infrastructure. A European recession is very likely but largely already reflected in financial markets.

Do you think Europe will blink and reduce sanctions on Russia?

Holding the EU coalition together won’t be easy but there is enormous pressure, particularly from the US, to maintain solidarity. Italian politics is a particular risk given Italy’s dependence on Russian gas and oil.

What role does gold play in our portfolios?

Gold has the enviable position of being a consistent performer during market drawdowns. Over the worst 30 months for equity markets from the last 30 years, gold has averaged a return of +1%, while the MSCI World has fallen on average -8.8%. For clients with lower risk tolerances, gold remains a strong investment to pair with equities to generate better risk adjusted returns. That said, we don’t aim to hold a fixed allocation, rather we increase our exposure when fundamentals and valuations look appealing and dial it back when the inverse is true.

Manager in focus: Snyder US All Cap Equity

Investment objective

The objective of this fund is long-term capital growth by targeting companies that can appreciate 50% over a 3-year time horizon.

They have an emphasis on downside protection by selecting high-quality companies while avoiding those that are more speculative.

Strategy

They do this by investing in 20-30 companies that, in their opinion, exhibit a set of high-quality characteristics, including:

- Differentiated and sustainable products or services

- Above average free cash flow

- Below average financial leverage

- Management team with a strong track record of both operational execution and capital allocation

They look to buy these businesses when they are trading at a discount to their estimate of their intrinsic value.

This is achieved through a bottom-up portfolio construction process based on intensive, fundamental research and valuation analysis, while incorporating a view of the macroeconomic factors.

Source: Snyder website

The managers

Gary Rafferty (17 years at Snyder). Before Snyder, Gary worked as an equity analyst at Prudential Equity, a management consultant at a McKinsey spinoff, and was an analyst at the Federal Reserve. He has an MBA from Columbia and a BA from Trinity College.

Charles Swain (11 years at Snyder). Before Snyder, Charles was Head of Industrial Research at RCM Capital, and was a Senior Investment Analyst at Brinson Partners. He has an MBA from Stanford, an MS and BS from MIT, and is a CFA Charterholder.

Saltus investment case

We decided to invest in this manager for the following reasons:

- In Snyder we found a US equity fund with significant deviations from the broader market, so we weren’t paying for an active manager who provides a return similar to a market that we could track with a cheap passive instrument

- We knew the US economy had many advantages over other countries but were worried about how expensive parts of the US stock market were, particularly the large tech/growth companies. Snyder’s focus on finding quality, smaller, and cheaper companies was very appealing

- This specific fund was only available to UK investors from 2021 and we chose to invest at its launch. Some investment managers would not invest in a fund without a track record. However, our analysis showed that Snyder as a firm has an enviable history of consistent outperformance over many years

- Through stock-picking skill rather than excessive risk-taking

- They screened excellently on our bespoke factor model that focusses on consistent alpha generation (alpha is a manager’s ability to beat their benchmark). Our model predicted a high probability of consistent alpha generation, which is exactly what’s happened

- Much of their historical outperformance has come from capital preservation, by not falling as much as the wider stock-market, but they also manage to generate strong positive returns on the upside

- Which is exactly the return profile most of our clients are looking for

- Because we were early investors, we secured a lifetime discount (0.35% per annum) regardless of how much additional capital we invest in the future

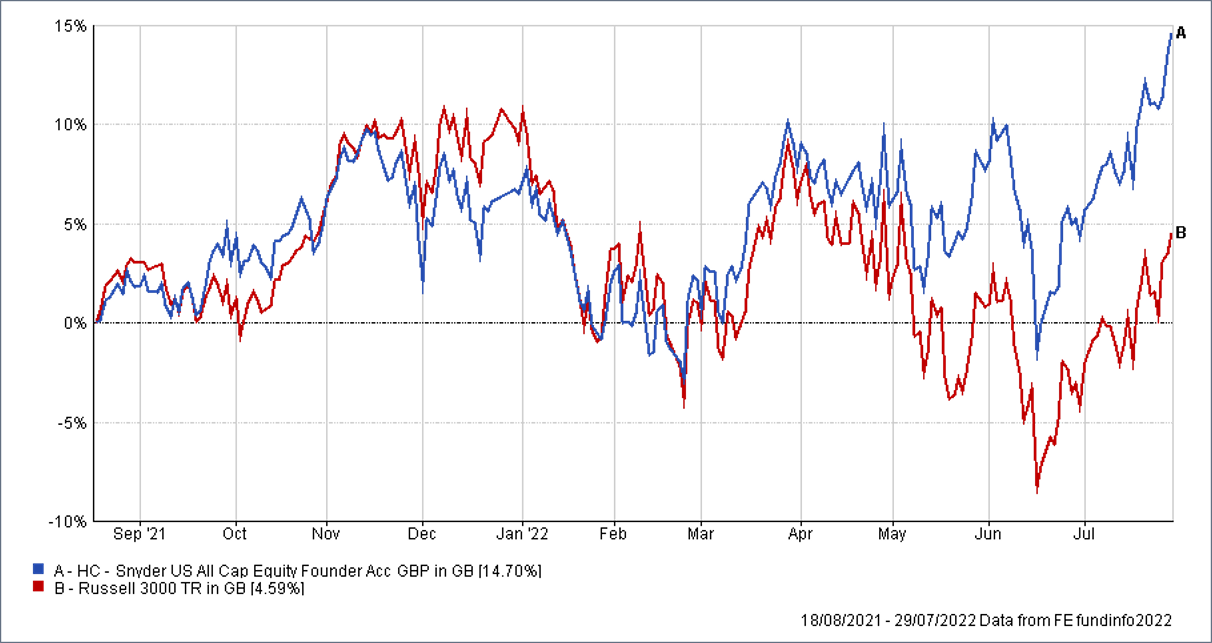

Performance

The fund has performed very well since its launch. Returning substantially more than its index, with lower volatility.

| 3 months | 6 months | 1 year | Inception | |

|---|---|---|---|---|

| Fund | 8.3% | 12.4% | 13.3% | 14.7% |

| Benchmark | 3.1% | 0.9% | 5.4% | 4.6% |

Source FE Analytics. Performance to 31 July 2022, after fees. Benchmark is Russell 3000 total return. Inception date of position 15 Aug 2021.

Asset Allocation Committee

The committee consists of several senior members of the investment team, all partners, who invest their own money alongside clients. The committee is led by:

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

The views expressed in this article are those of the Saltus Asset Management team. These typically relate to the core Saltus portfolios. We aim to implement our views across all Saltus strategies, but we must work within each portfolio’s specific objectives and restrictions. This means our views can be implemented more comprehensively in some mandates than others. If your funds are not within a Saltus portfolio and you would like more information, please get in touch with your adviser. Saltus Asset Management is a trading name of Saltus Partners LLP which is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.