Effective financial planning can help you achieve your goals in life, whether it’s a comfortable retirement, buying the home you always wanted, saving for school fees or passing on your wealth. We can support you by:

Providing financial plans at every stage of life

Saltus financial planners are experts at creating financial plans for clients at every stage of life. Our mission is to help you take control of your finances. We can help you map out your financial and life goals and ensure that you have a plan that will deliver them.

Catering for your needs

We can create a personalised and collaborative financial plan with you by listening to, and understanding, your needs and then applying our knowledge and expertise. This not only ensures your money continues to deliver for you but builds enduring personal relationships based on trust and experience.

Navigating the investment world

We will help you to navigate the complex landscape of the investment world and assist with structuring your investments in a tax-efficient manner.

As an independent financial planning firm, we are able to provide objective advice that is aligned with your best interests. We can offer the best of both worlds, either using in-house investment strategies managed by Saltus Asset Management or from an alternative provider, depending on your objectives.

Do you need help with your financial planning?

Our advisers can create a financial plan to help you achieve your financial goals, whether it’s a comfortable retirement, improving your tax position or passing on your wealth. Get in touch to discuss how we can help you.

What to expect from our financial planning service

An award-winning proposition

We’re award winning and proud of it. We’ve been recognised not just for our expertise but the quality of our client relationships and service too.

A chartered firm at the forefront of our profession

Saltus Financial Planning is a ‘Chartered’ financial planning firm. It is a recognition awarded to only a small number of firms that are at the forefront of our profession.

Achieving Chartered status means that we have met the highest standards for technical competence in the advice we provide to clients. It also demonstrates our dedication to continued professional development and shows that our clients are at the heart of everything we do.

A highly qualified team

We are specialists in financial planning and have been supporting our clients with their finances for over 20 years. Our team consists of some of the most highly qualified advisers in the country.

We’ll explore your objectives and requirements in detail, taking everything into account to create a personalised and bespoke financial plan.

A bespoke plan for you

We can create a personalised and all encompassing financial road map for our clients. Prior to investing, we can provide a clear recommendation on areas such as how much you need to save towards retirement, pension advice and consolidation, how much income you can draw from your investments, minimising your tax burden now and in the future, what return your investments need to generate to deliver your plan and how to pass on your wealth effectively.

We harness the latest technology

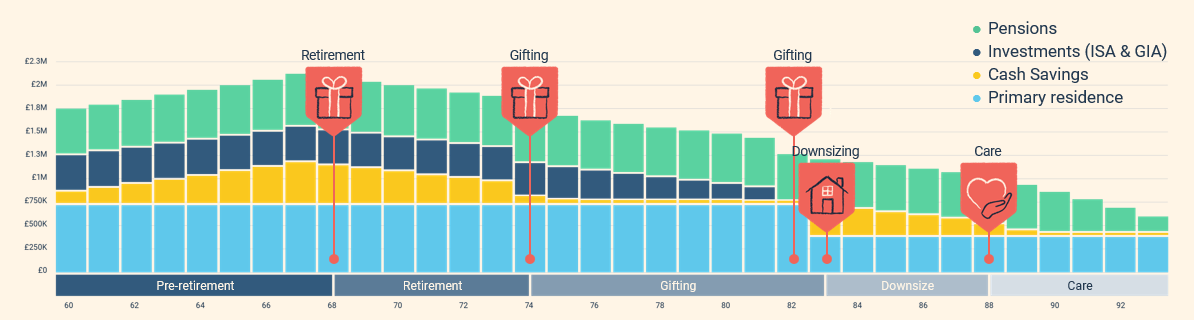

We harness the latest and proprietary technology to deliver our service. This might be using our bespoke cashflow modelling software to help bring your plan to life, or it could be providing an unrivalled experience through our in-house mobile app so you can easily view how your money is invested.

Effective cashflow planning, for example, has the potential to be life changing. Your assets, liabilities, regular saving plan and financial goals can be input into the modelling software. These can be overlayed with different assumptions such as expected investment growth, to help establish if you have enough money to achieve all your goals.

A wide range of award-winning investment solutions

We provide a wide range of investment management solutions so we can find the one that best meets your needs, with the aim of delivering optimal risk-adjusted returns. As a financial planning client, you’ll have access to the Saltus Asset Management team so you can have a clear understanding of their investment views.

We’ll work around you

We’ll work around you, with the ability to hold meetings via video, at your home, at your workplace, or at one of our offices

Saltus Financial Planning is a 'Chartered' financial planning firm

What our clients have to say about us...

How it works:

Initial call

A quick call to establish if we're the right partner for you and which adviser is best placed to help meet your needs…

Initial call

A quick call to establish if we're the right partner for you and which adviser is best placed to help meet your needs…

Discovery meetings

Your Saltus adviser will spend time getting to know what really matters to you. They'll determine your financial goals and aspirations and understand any concerns you may have too…

Discovery meetings

Your Saltus adviser will spend time getting to know what really matters to you. They'll determine your financial goals and aspirations and understand any concerns you may have too…

Proposal

Our expert team will provide a complete financial overview and produce a personal recommendation to achieve all your goals, big and small…

Proposal

Our expert team will provide a complete financial overview and produce a personal recommendation to achieve all your goals, big and small…

Start our journey together

We’ll take care of any transfers and begin a long term relationship that will evolve over time…

Start our journey together

We’ll take care of any transfers and begin a long term relationship that will evolve over time…

Our service levels…

Saltus Premier

For clients wanting high quality advice delivered in an approachable and relatable way…

Saltus Private Office

For individuals with significant assets requiring a team at the centre of their financial sphere…

Financial Planning Frequently Asked Questions

What areas of financial planning can you help with?

What types of clients do you work with?

We work with individuals from all walks of life and have a diverse client list consisting of people from professional backgrounds (including senior executives, entrepreneurs, lawyers, accountants, consultants and others) and non-professional backgrounds alike.

We typically work with clients with £250,000 or more in investable assets.

How much money do I need to be comfortable?

This has to be one of the most common questions we are asked as financial planners. The reality is that everyone is different. We’ll take the time to analyse what you spend now, and how this may change in retirement to help provide you with a precise answer. We have written an article on the subject, if you’d like to find out more

What makes Saltus different?

We work in partnership with our clients and can take care of all your needs in one place, all supported by industry leading technology.

As well as surrounding you with a team of highly qualified individuals, we have our own platform, can provide the tax wrappers you require, source investment solutions from the wider market or from our award-winning asset management team, and review your protection needs to ensure your family are looked after should the worst happen.

How do we get started and how much will it cost?

Once you have contacted us, we’ll have an initial discussion to understand more about what you are trying to achieve and how your existing assets and investments are structured. We’ll then have some further meetings to garner an in-depth understanding of your requirements and provide you with a report that outlines our recommended financial plan.

There’s no charge for the initial steps. As our plans are bespoke to your objectives, charges will depend on what’s recommended to you. These will be outlined in full before you progress with us.

Request a call back...

Contact us today to discuss how we can help you.

Alternatively, you can call us on 01489 663700 (Open Mon-Fri, 9am – 5pm)

About Saltus?

Find out more about our award-winning wealth management services…

Nominated

Good Money Guide Investment Awards 2026

Winner

Top 100 Financial Advisers

Winner

Best Wealth Manager

Winner

Investment Performance: Cautious Portfolios

£10.4bn+

assets under advice

20

years working with clients

450+

employees

97%

client retention rate

Discover more

Pensions and retirement planning

Deciding when to retire is a challenging decision and can feel like a leap of faith. At Saltus, we gather information on all of your existing assets and then use our technology and expertise to show you exactly how to achieve the retirement you’re after.

Reducing your tax burden

How to structure your wealth and access income should be approached in a sophisticated way. A detailed financial plan may use pensions, ISAs, general investment accounts, offshore bonds and other tax wrappers to ensure you can draw your money in a tax-efficient manner.

Consolidating your wealth

Holding multiple investment accounts and pensions can mean they’re hard to keep track of and administer. We’ll help you overcome this by consolidating your accounts into a single plan so that you can understand your financial position with ease.

Protecting you and your assets

We protect our cars and houses without much thought yet you might be the most valuable asset in your family. Whatever your situation, we can provide advice to ensure you have the right level of insurance in place to keep your finances protected.

Passing on your wealth

Estate planning is more important than just having a Will. We’ll work closely with you to understand how estate planning, which has emotional as well as financial consequences, can impact your overall financial plan.

Significant life events

Significant life events can present great opportunities but also considerable challenges. Whether you are going through a business sale, divorce or are receiving a lump sum, we’ll help build a financial plan to meet your changing lifestyle.