Investment conditions

The last quarter of 2024 was generally positive from an economic growth perspective, closing out a positive year overall. Of the major economies to publish 2024 GDP growth data, the US grew 2.8% in 2024, the UK 0.9%, the Eurozone 0.7% and China at 5%. Germany was a noticeable underperformer, finishing the year with -0.2% growth. The IMF predicts global growth of 3% for 2025. Breaking this down sees forecasts for the US of 2.7% growth, China 4.6%, the Eurozone 1%, Japan 1.1%, and the UK 1.6%.

Inflation remains stubborn in most major regions except China. At the latest reading, headline consumer prices rose 3.0% in the US, 2.5% in the Eurozone, 2.5% in the UK, and 3.6% in Japan, all above central bank target levels. China is still flirting with deflation, with a 0.5% inflation reading for January 2025.

Unemployment is still near historic lows in the developed economies. This is supporting healthy wage growth, which is bolstering the consumer. A buoyant consumer has been a key pillar of economic growth and earnings growth in this cycle.

Fourth quarter earnings season has been robust, with companies continuing to see positive sales and earnings growth, and margin expansion. Global earnings growth is set to be near 10% in 2024 as a whole, rising to 12% in 2025, with the US and Emerging Markets being the bright spots at 12.0% and 18.9% respectively. The UK and Europe are the laggards, with 7.0% and 8.8% expected earnings growth for 2025. This is reflected in valuations with the US being overvalued relative to its long term average, and the UK and Europe looking undervalued.

There is a mixed picture in central bank interest rate policy. The US Fed paused their rate cutting journey at the most recent meeting. The Bank of England and the European Central Bank cut their base rate by 0.25% at their most recent meetings, to 4.5%, and 2.75% respectively. The Bank of Japan hiked rates to 0.5% at their latest meeting. In the US, expectations for rate cuts in 2025 have been tempered. Apart from Japan, central banks are still generally moving in a lower rate direction, but are proceeding more slowly given the heightened uncertainty around growth and inflation in 2025.

Market Themes

Tariff Man

Donald Trump’s second term has got off to an eventful start. Not only did he sign more executive orders in his first 10 days than any recent president did in their first 100 days, but he has also fired the starting gun on multiple trade wars. On Saturday 1st February, Trump issued an executive order applying additional tariffs of 25% to all imports from Canada and Mexico, with the exception of Canadian oil and energy products, which faced a 10% levy. He also applied an additional 10% levy over and above existing tariffs on imports from China. By Monday 3rd February, following discussions with Canada and Mexico, he decided to put these on hold for 30 days. The China tariffs still stood though, and China retaliated in a limited manner so as not to escalate the situation. Trump then built on this on 9th February by announcing 25% tariffs on all US imports of steel and aluminium, widening the net of his protectionist agenda.

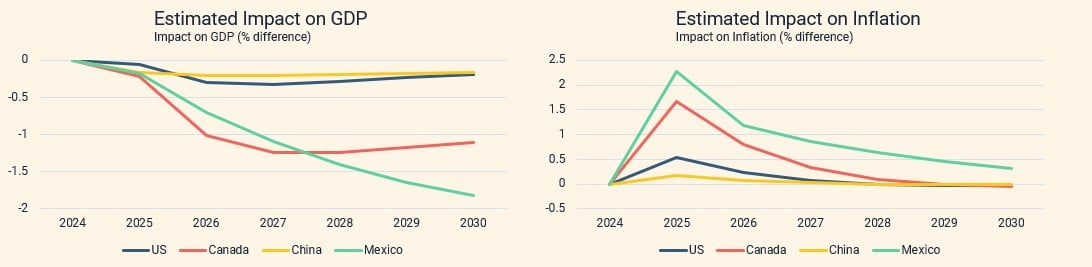

The US should be relatively unaffected because it is a closed economy and its trade with Canada, Mexico and China make up a tiny part of US GDP (2.8%, 2.9%, and 2% respectively). However, Canada and Mexico are much more exposed, with 34.2% and 42.5% of their GDP coming from trade with the US respectively. The charts below show the estimated impact on economic growth and inflation in the four countries from a simulated 25% tariff on Canada and Mexico, an additional 10% on China, plus reciprocal retaliatory measures. The tariffs announced so far have a far more meaningful impact (if imposed) on Canada and Mexico than they do on the US or China. These forecasts are open to a huge amount of uncertainty, for example, will the tariffs even be imposed, how long will they be imposed for, and will attention shift to the EU. Even when a decision is taken, we have seen how quickly it can be reversed.

There is no consistent motivation or objective for these actions. We don’t know whether the aim is to raise revenue, rebalance trade, improve national security, or to act as negotiating tools. There is no such thing as certainty under a Trump presidency, which makes it difficult to make predictions. What we can be sure of though, is that more economic uncertainty results in more volatility. We believe it is sensible to position for a more volatile environment.

Source: Saltus, Peterson Institute for International Economics (PIIE)

Europe’s Solid Start

Europe was the best performing major stock market in January, with the MSCI Europe ex-UK index up 7.1% in the month. This compares with 2.8% for the S&P500 index in the US, which has been dominant for a number of months (left chart below). The strongest sectors in Europe were financials and consumer discretionary stocks, reflecting the improving economic backdrop in the region. A low weighting to technology in the index also helped as the sector struggled due to the emergence of Chinese AI company DeepSeek. DeepSeek has called into question the value and earnings assumptions in the AI ecosystem stocks.

It would be a brave prediction to say that this is the start of a long trend that will see European stocks finally outperform their US counterparts, but conditions could be starting to turn in Europe’s favour. Firstly, and most obviously, is the relative starting points. The valuation gap between European and US stock markets is large as the right chart below shows. The MSCI Europe ex-UK index trades at nearly 17x on a forward price to earnings ratio versus almost 27x for the S&P500. If we start to see policy uncertainty start to slow the US economy and Europe continues to enjoy positive economic momentum, this valuation gap could start to close in Europe’s favour. The direction of monetary policy could boost Europe’s fortunes too, the ECB has just cut rates to 2.75%, with the expectation that more cuts are on the way. This contrasts with the Fed that is on pause, with economists expecting only one or two cuts in 2025 as a whole. The economic, inflation and interest rate backdrop in Europe could result in higher allocations towards the region, and this is before taking into account other possibilities such as significant fiscal easing, Chinese stimulus, a peace deal in Ukraine, and a turnaround in Germany’s manufacturing sector as examples.

Source: Saltus, Bloomberg

Views by asset class

Equities

The two most significant events that have taken place since the last asset allocation committee meeting have been the imposition of trade tariffs and the emergence of DeepSeek. Both of these developments lead to more questions and uncertainty about the future path for US equities, with the DeepSeek news specifically affecting the sectors that have enjoyed an AI-driven tailwind over the last couple of years.

Over the last twelve months, we have been gradually moving away from market capitalisation-weighted US equity exposure, given the high concentration in the biggest technology companies. We have been moving towards a broader US equity exposure through a mix of equal-weighted S&P500 exposure and active managers with a value focus. We are confident that our portfolios are less exposed to any dents in the AI narrative that come from here, but we still have exposure to the wider US market given the positive economic and corporate earnings outlook. There is caution, however, on the tariff point and what effects these could have on US economic growth and corporate profitability. The committee are actively monitoring the potential risks to this part of the portfolio.

Given these heightened risks around US equities, the committee decided to gradually continue adding to our favoured ex-US exposures. The first of these is a small addition to our European equity exposure, for many of the reasons listed in the above section. This will be done through an addition to our European smaller companies fund holding. The other exposure to increase is Emerging Market equities. Earnings growth forecasts for Emerging Markets are the highest in the world for 2025 and 2026 and valuations are still attractive versus developed markets and in absolute terms. GDP growth remains strong, higher than in developed markets and there are a number of local market reforms taking place, which should boost domestic investor participation in specific markets, e.g. India and Vietnam.

Bonds

Although government bond yields look relatively attractive, the committee are still cautious about the outlook for inflation, economic growth and interest rates, especially in the US. We continue to favour ex-US government bonds – primarily UK government bonds – as we believe there is more scope for interest rate cuts, lower inflation, and lower economic growth. Where we do have US government bond exposure, this is through inflation-protected bonds, given concerns around sticky inflation.

We continue to maintain a low exposure to corporate credit, both in investment grade and high yield. We see these parts of the market as expensive and where we do have exposure, it is through active managers who can be flexible and can exploit discrepancies at the individual bond level.

The committee decided to allocate to two new bond positions. The first is a market-neutral global bond fund which invests in government bonds of the 10 largest economies in the world. There is more detail on this fund in the Fund in Focus section below. Given that the fund aims to perform positively regardless of the direction of stock or bond markets, this fund could fall into our alternative asset class exposure, as it offers an uncorrelated return stream to the overall portfolio. The second addition is an active Emerging Market debt fund. Emerging Market bonds are cheaper than their developed counterparts, have higher yields, and the countries don’t have the same debt sustainability issues. This is not a diversifying holding, this is to provide positive performance in a risk-on environment through flexible and opportunistic active managers.

Alternatives and Currency

Given the increased likelihood of volatility in financial markets in the coming months, the committee decided to continue our gradual move from equities and bonds into alternatives. This is done with a view to taking profits in assets that have performed strongly over the last couple of years and increasing the portfolios’ overall diversification.

The committee agreed to reduce the copper exposure in portfolios, given strong recent performance. This is more of a tactical decision and we would hope to increase our position again if the price falls from here. We still believe in the long term case for copper, where demand is set to increase given its importance in the energy transition, but supply is constrained as the miners haven’t been spending on new sources.

For the lower risk band portfolios, the committee decided to trim the gold miners position back, following a strong run, consistent with the volatility targets for those models.

We still have a preference for Japanese yen exposure, but no action was taken on the currency exposures.

Summary of positioning

Below is a summary of our views for each asset class, from strongly negative (- -) to strongly positive (+ +).

Asset Class

| Asset class | -- | - | Neutral | + | ++ |

|---|---|---|---|---|---|

| Equities | X | ||||

| Government bonds | X | ||||

| Corporate bonds | X | ||||

| Alternatives | X | ||||

| Cash | X |

Asset Class Breakdown

| -- | - | Neutral | + | ++ | ||

|---|---|---|---|---|---|---|

| Equities | USA | X | ||||

| UK | X | |||||

| Europe | X | |||||

| Japan | X | |||||

| Asia ex-Japan | X | |||||

| Emerging markets | X | |||||

| Bonds | US Government | X | Non-US Government | X | ||

| Inflation-Linked Government | X | |||||

| Investment Grade Corporate | X | |||||

| High Yield Corporate | X | |||||

| Emerging Market Debt | X | |||||

| Alternatives | Commodities | X | ||||

| Gold & Gold Miners | X | |||||

| Property | X | |||||

| Global Macro | X | |||||

| Equity Long/Short | X | |||||

| Absolute Return | X | |||||

| Infastructure | X | |||||

| Currency | Sterling | X | ||||

| US Dollar | X | |||||

| Euro | X | |||||

| Japanese Yen | X | |||||

| Emerging Markets | X |

Fund in focus: Brevan Howard Absolute Return Government Bond Fund

Summary

The Brevan Howard Absolute Return Government Bond Fund uses an investment strategy which focuses on government bonds of the 10 largest economies in the world. The team aims to achieve positive returns that are uncorrelated to stock and bond market conditions on a rolling 12 month basis, with relatively stable levels of volatility. They do this by having a deep understanding of economic and financial forces, and identifying mispricing in government bond markets with an emphasis on diversification, value and proactive risk management.

The fund focuses on the largest government bond markets in the world due to their high quality, size, depth, and liquidity. The fund avoids corporate bonds and emerging market bonds given the additional risks in these segments. The fund can use government bond-related instruments such as inflation-linked bonds, interest rate derivatives, and foreign currencies.

The strategy is based on the team’s medium-term global macroeconomic view, which usually has three to five core themes. The team has worked together on similar strategies for over 14 years, starting this particular fund in July 2019. Since then, they have achieved impressive, sector-leading risk-adjusted returns.

We have recently invested in this fund as part of our alternative exposure, with the aim of increasing diversification and improving risk-adjusted return. The fund offers attractive diversification benefits, as it should be uncorrelated to stock and bond markets, and aims to achieve a positive return regardless of market direction.

Brevan Howard and the Team

Brevan Howard is one of the largest European hedge fund management companies. It was founded in 2002 by Alan Howard, alongside four other co-founders. Currently, the firm has over 1,000 investment professionals and 150 portfolio managers across eight offices in London, New York, Hong Kong, Singapore, Abu Dhabi, Geneva, Jersey and Austin. The firm specialises in global macro strategies, which are investment strategies that base their holdings primarily on macroeconomic forecasts of countries, although they have recently branched out into the digital assets space. Assets under management have fluctuated through the years, peaking at $40bn in 2013. Current assets aren’t far off that peak at $35bn. Roughly $12bn sits in the flagship Master Fund which aims to generate consistent long-term capital appreciation through active leveraged trading on a global basis. Exposure is predominantly to global bond and currency markets, employing a combination of global macro and relative value trading strategies. BH Macro is a London-listed investment trust which allows UK investors access to the Master Fund. Saltus are also investors in BH Macro.

The team that runs the Absolute Return Government Bond Fund is made up of 6 members; four portfolio managers, a quantitative developer and a trade analyst. The portfolio managers are responsible for research, day to day management of the portfolio, and trade execution. These are shared functions which the portfolios managers work on collaboratively. Adam Purzitsky and Paul Shanta are the co-head portfolio managers. They have worked together since 2009 and have been running this strategy together since 2011, first at Ignis Asset Management, then at Meridian Global Investors. They joined Brevan Howard in October 2018 and launched the fund in July 2019.

Source: Brevan Howard

Philosophy

The primary goal is to generate positive returns over any rolling 12 month period. The team believe that inefficiencies and mispricing across their investment universe creates ample opportunities to construct a diversified portfolio that effectively reflects their global macroeconomic views.

Risk management is a cornerstone of their philosophy. The team continuously evaluate core themes whilst stress-testing the portfolio against potential scenarios where their main views may prove incorrect. In these scenarios, they prioritise diversification and hedging positions, allowing them to maintain conviction in their core views whilst managing downside risk effectively. The team believe their strategy has a distinct edge in three key areas:

- Portfolio construction – focusing solely on developed market government bonds whilst avoiding emerging markets and corporate bonds eliminates credit risk from the portfolio. Since the strategy’s inception, it has maintained a near-zero correlation with traditional asset classes.

- Diversification driven process – breaking down developed market interest rates and inflation into granular components enables precise positioning based on the team’s views. This has led to a strong track record of outperformance whilst maintaining a low correlation to competitors and financial markets.

- Collaborative team structure – the team operate through a collaborative approach to risk management, idea generation and portfolio construction. This structure fosters diverse input from members with complementary skill sets. The lead portfolio managers have worked together since 2009, demonstrating a proven ability to collaborate effectively and generate strong risk-adjusted returns in that time.

Process

The goal is to identify key macroeconomic themes over the next 12-18 months and then find the most compelling risk-reward opportunities around these themes. Once these opportunities have been identified, the next step is to build hedges around them that are designed to perform well in scenarios where the core portfolio might face losses. Complementing the macro strategy, the team can also carry out short-term opportunistic trades to exploit inefficiencies that arise. Positions typically have holding periods ranging from a week to a few months.

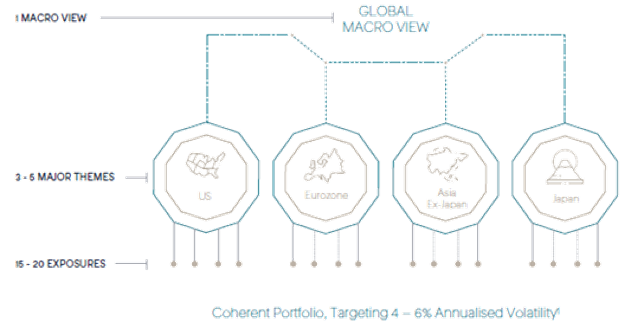

The portfolio is usually well-diversified, built around three to five major themes across G10 geographies and expressed through 15-20 overall exposures. A key element of the investment strategy is the creation of a cohesive portfolio rather than a collection of individual strategies.

Source: Brevan Howard

In the final stage, the same approach is used to identify offsetting trades or hedges that are expected to generate positive returns whilst protecting against potential losses. The focus here is understanding correlations in different market conditions whilst preserving upside potential.

Portfolio and performance

Using a peer group of Global Macro Discretionary funds, this fund is comfortably above the average performance over the long term. The fund’s management fee is below the average of this peer group too.

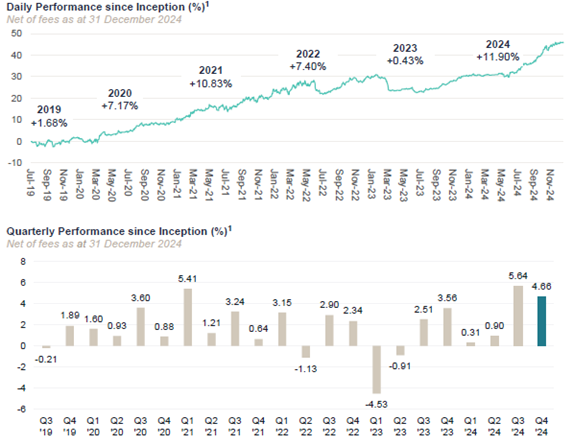

Performance since inception of the fund in July 2019 has been strong, and the team’s track record prior to Brevan Howard has been equally impressive. The fund has generated an average annualised return of 7.3%, with a Sharpe Ratio (a measure of risk adjusted returns) of around 1.

Source: Brevan Howard. Performance is quoted net of Brevan Howard fees.

Saltus Rationale

This fund offers a competitively priced absolute return, global macro strategy that has a very strong track record, a stable team and fits with our overall outlook of rising market and economic volatility.

With strong risk-adjusted returns, and low correlation to other major asset classes, the fund makes a good addition to our existing absolute return exposures, which consist of long/short equity strategies, event driven strategies, and convertible arbitrage strategies. The aim of these exposures is to diversify overall portfolios and improved risk-adjusted returns at a portfolio level.

Saltus use this fund as part of a diversified portfolio. This is not a recommendation to invest in this fund. Saltus will not be liable for any losses incurred as a result of investing in this fund.

Asset Allocation Committee

The committee consists of several senior members of the investment team, all partners, who invest their own money alongside clients. The committee consists of:

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

The views expressed in this article are those of the Saltus Asset Management team. These typically relate to the core Saltus portfolios. We aim to implement our views across all Saltus strategies, but we must work within each portfolio’s specific objectives and restrictions. This means our views can be implemented more comprehensively in some mandates than others. If your funds are not within a Saltus portfolio and you would like more information, please get in touch with your adviser. Saltus Asset Management is a trading name of Saltus Partners LLP which is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.