Investment conditions

Growth (economic)

Once again, the global economy has demonstrated its resilience, although a slight negative shift in momentum is evident. Recent trends in leading indicators have signalled a gradual cooling of most major economies. The key issue investors are grappling with is whether we will see recessions and, if so, what form those recessions will take.

Headline inflation has been falling but prices remain high, reducing spending and excess savings. Excluding shelter costs, annual inflation in the US is now at the Fed’s 2% target. Headline inflation remains high in many countries – recent Consumer Price Index (CPI) readings being 6.3% in the UK, 3.7% the US, 4.3% in the Euro area, and 3.1% in Japan – but, crucially, all have fallen over the last twelve months, excluding Japan. Inflation remains one of the key variables influencing central bank policy, economic growth (e.g., the likelihood of recession), and financial markets.

Higher interest rates and lending standards combine to make financial conditions tighter than in recent history, restricting finance (borrowing) by corporates and individuals, reducing growth.

Unemployment remains at or near historic lows in the Eurozone (6.4%), UK (4.3%) and US (3.8%), but these have increased in recent months. UK unemployment is at half its peak post 2008 Financial Crisis. Wage growth is robust, with the period from April to June exhibiting the most substantial regular annual growth rates observed since 2001, standing at an impressive 7.8%.

Looking ahead, the IMF expects global growth to fall from an estimated 3.5% in 2022 to 3% in 2023 and 2.9% 2024, below the historical (2000-19) average of 3.8%, but positive growth, nonetheless. These numbers could be boosted by an uptick in China’s economy, which is emerging from a soft patch, retail sales there were lifted by recent government stimulus and factory activity has stabilised after months of weakness.

Interest rate & liquidity environment

Most major economies have been raising interest rates in an attempt to cool inflation. However, interest rates are not expected to move much higher because inflation has been falling. The risk of a policy mistake by central bankers is elevated in our view. Reduce rates too soon and inflation could rise again, as was the case in the 1970s. But keeping rates too high for too long could damage companies and consumers with high debt levels. This is a difficult balancing act, especially since the impact of higher rates generally takes 12 to 24 months to be felt. China is stimulating activity via lower interest rates and increased liquidity.

Valuations & earnings outlook

At the global level, corporate earnings have been resilient, and higher than expected in many areas. However, the breadth of earnings is falling, meaning some sectors are struggling more than others. Profit margins were at record highs but have fallen slightly due to rising costs.

On a regional level, corporate earnings in the United States have just reached an all-time high, and analysts expect robust earnings growth next year. Earnings in the UK have been falling but analysts currently expect a small recovery next year. For developed markets, Japan is a standout performer for profitability, with corporate earnings expected to grow 10.5% this year, and 5.8% in 2024. Earnings within Emerging Markets have fallen this year, but analysts expect a strong recovery next year with +18.6% expected earnings growth for 2024.

The US stock market is the only major region that is meaningfully overvalued compared to history, investors are prepared to pay more for companies listed in the US in general, and especially for those expected to profit most from new technologies (e.g. artificial intelligence). The UK stock market is very cheap compared to history, trading about 30% more cheaply than its 10-year average (price to earnings ratio).

Assessing the value of different asset classes compared to historical patterns indicate that investors are now pricing in a lower probability of recession than they did earlier this year. However, many assets are still trading significantly more cheaply than others, for example smaller company stocks (especially the UK and mainland Europe), as well as many emerging and frontier markets.

Sentiment / flows

Stock market volatility has been fairly low all year, the widely followed VIX index has rarely edged above its long-term average of 21 throughout 2023. It increased from a low of 13 at the start of September to around 22 at the time of writing, reflecting some investor concern about the path ahead (but barely above its long-term average). Readings above 30 generally indicate fears of large drawdowns in stocks, so we are not there yet. Stock market momentum is pointing downwards in many markets as some investors have been reducing stock allocations, de-risking portfolios. Additionally, market breadth has been falling, and demand for insurance contracts (e.g., put options) on stocks has been increasing as more investors have been protecting against downwards movements.

Views by asset class

Equities

Measures of global stocks show good gains year to date (around +10%). However, returns have been flattered by a few very large companies experiencing very large gains, mainly attributable to expected revenue growth from artificial intelligence. This is most evident if you look at the performance of the US stock market, the S&P 500 tracks the largest 500 companies in the United States, this index is up about 13% this year. But if you exclude the “Magnificent Seven” (Nvidia, Meta etc) the +13% becomes just +4% for the remaining 493 US companies. There have been very few winners this year.

Mindful of how expensive these technology companies have been, and in an effort to avoid potentially large drawdowns from expensive stocks (as has happened several times over the last 50 years, most notably Nifty Fifty in the 1980s, and the dot-com bubble of the late 1990s), the asset allocation committee has had less exposure to these companies than would have been optimal for clients.

Instead, the asset allocation committee has been focussing on less expensive companies, those with greater margin of safety in their stock price. So far this year this has detracted from performance, but this was done in an effort to safeguard investor capital.

That said, for some time now, the committee has been tilting stock portfolios towards “quality” companies, those with stronger balance sheets and less volatile earnings, which has been very beneficial for portfolios. In the most recent meeting, the asset allocation committee decided to further increase the “quality” of our stock positions, for even greater resilience.

Among developed markets, we express a preference for Japanese equities, given the ongoing accommodative policy, presence of negative real interest rates, and the implementation of shareholder-friendly reforms that are taking hold. Japanese equities have outperformed even US equities this year. The committee decided to maintain this exposure which has been working well (see Manager In Focus section of this report).

We had recently decided to increase exposure to Asia, emerging markets, and frontier markets. This decision has contributed meaningfully to investment portfolios. Many of these countries are ahead of developed markets when it comes to growth and recovery, they haven’t had the same cost increases as some Western countries and have been trading more cheaply than many developed markets.

We remain unconvinced about the case for European equities, given uncertainties over many factors in the region, such as ongoing weakness in Germany. Because of the uncertainties, our exposure to European stocks comes mainly via a long/short equity manager, because they can generate returns from both rising and falling stock prices.

Overall, we continue to tilt our equities towards quality companies (those typically more resilient when the outlook deteriorates), value companies (which are cheaper than the average stock so have a greater margin of safety in the price), and smaller companies (which are trading more cheaply than the average stock). We remain more cautiously positioned than we could be, mindful of the uncertain economic environment.

Government bonds

The last two years has been the worst two-year period in history for US government bonds, and UK government bonds have lost about a third of their value over the last three years (conventional all stocks UK Gilts -32% over three years). Attracted by yields of close to 5%, the asset allocation committee have been slowly increasing our allocations to both of these markets, but to date this has proven slightly premature as yields have continued to rise (so bond values have continued to fall). However, given the relatively attractive yields, and the potential for meaningful growth in value should there be a flight to safety, the committee maintained this exposure.

Corporate bonds

In a recent committee meeting it was decided to increase our exposure to emerging market bonds, which have performed well since the decision was made. In the most recent meeting, the committee decided to take profits from some of this exposure, and place the proceeds into US investment grade bonds, since you can now get the same expected return lending money to credit-worthy US companies than you can lending money to emerging market governments.

The committee decided to maintain some exposure to emerging market bonds, which are still trading at noticeable discounts, offering both attractive yields and the possibility of substantial increases in their value. Additionally, emerging market bonds should gain from a weaker US dollar, which contrasts with other parts of our portfolio that would benefit from a stronger dollar.

Alternatives

Alternative asset classes can provide protection during market falls, with returns not correlated to the rest of the portfolio. For this reason, we are still positive on this asset class.

We have positions in broad commodities as well as copper, all of which look undervalued on a long-term view. We have some macro hedge funds that can add significant value in times of heightened volatility. We also have positions in gold and gold miners, gold can provide meaningful protection when inflation surprises on the upside, and gold miners are significantly undervalued in our view.

Overall, the environment is characterised by high uncertainty about the macro-economic outlook, so we remain cautiously positioned, but prepared to take advantage of opportunities that present themselves.

Summary of positioning

Below is a summary of our views for each asset class, from strongly negative (- -) to strongly positive (+ +).

Asset Class

| Asset class | -- | - | Neutral | + | ++ |

|---|---|---|---|---|---|

| Equities | X | ||||

| Government bonds | X | ||||

| Corporate bonds | X | ||||

| Alternatives | X | ||||

| Cash | X |

Asset Class Breakdown

| -- | - | Neutral | + | ++ | ||

|---|---|---|---|---|---|---|

| Equities | USA | X | ||||

| UK | X | |||||

| Europe | X | |||||

| Japan | X | |||||

| Asia ex-Japan | X | |||||

| Emerging markets | X | |||||

| Bonds | Government | X | ||||

| Index-linked | X | |||||

| Investment grade | X | |||||

| High yield | X | |||||

| Emerging market | X | |||||

| Convertibles | X | |||||

| Structured credit | X | |||||

| Alternatives | Commodities, gold + miners | X | ||||

| Macro hedge + other alts | X |

Investment Committee Q&A

The Committee last met two months ago, what has happened since then?

A lot, but I would pick out three things: the rise in real interest rates, the Hamas attack on Israel, and US S&P 500’s corporate earnings reaching a new all-time high in the third quarter. I include the last of these as it is easy to get too gloomy given all the interest rate rises and events and uncertainty surrounding the Middle East. But the US economy, and US companies, are extraordinarily dynamic and resilient. The key issue though is the rise in US and global interest rates, given that it is US long bond yields and particularly real, i.e., after inflation, yields that underpin pricing of all financial assets, at least in the ‘’free’’ World. 10-year US Treasury bond yields have recently risen back to just under 5% for the first time since 2007, for example, and US 30-year fixed mortgage rates at 8% are at their highest level since the 1990s.

What has been driving investment markets in this period?

The rise in interest rates has been something of a surprise to many including a lot of financial market professionals. The investment market impact has been most felt, again, in fixed income where bonds have continued to sell off as yields have risen even following last year’s big price falls. Fixed income volatility is now, for example, above equity volatility. And bonds used to be seen as the safe holdings in a portfolio! The ‘hit’ to bond pricing since the beginning of last year is now the worst two-year bond rout since the 1870s. In a historical context the surprise should not be the rise in rates but rather the aberration was how low interest rates fell in the 2009 to 2020 period. What has happened in the last 18 months is really only a return to “the old normal”. The problem is that too many individuals, households and governments became conditioned to a regime of low nominal and particularly low real interest rates. The key though is the rise in ‘real’ rates, and this can be measured by the fact that medium term inflation expectations have barely risen and by the yields on index linked bonds relative to conventional bonds. The reason for this rise in real yield is overwhelmingly to do with the deterioration in the supply/demand balance for US government debt. The US is running twin fiscal and current account deficits, as indeed is the UK without the benefit of providing the World’s reserve currency, so needs to attract capital from abroad. It appears many countries, particularly China, have been reluctant to ‘park’ their foreign exchange reserves in US$ given the significant deterioration in their bi-lateral relationship. What has really unnerved investors, however, is the major deterioration in the US government’s fiscal position which is highly unusual while the economy is strong. US government debt/GDP is approaching 120%, having been in the low 50%s in 2000 when the government ran a primary surplus. This summer, Fitch downgraded the US government’s credit rating from AAA. The implications of the rises in rates are huge, not least for governments where debt servicing costs have risen substantially, and again in the UK is largely the reason the Chancellor, and indeed future governments, have so little flexibility to reduce taxes. Within financial markets government bonds have sold off, as have those areas, like property, private equity, and infrastructure that tend to employ leverage.

What has been working well for our portfolios, and what has been less effective?

What hasn’t worked is the gradual increase in the duration of our bond portfolios and the particular emphasis on government bonds. This strategy was based on a view into the beginning of this year that inflation, particularly in the US, would peak and start to fall. We have been right on the inflation call but certainly didn’t expect the speed or the scale of the rise in real interest rates. Corporate credit has generally performed better than government bonds, which we didn’t anticipate as we expected credit spreads to widen. This hasn’t happened as there is so little issuance. Looking forward, however, corporate bond supply will need to pick up materially as corporates refinance their debt at higher rates and we continue to believe that, for example, high yield credit spreads will widen. Before we get too hairshirt-ish, our longstanding negative view on China, our emphasis on quality companies in equity portfolios and a cautious view on overall risk in portfolios have all been very helpful.

Since the last meeting we have seen an increase in geopolitical tensions, most notably in the Middle East. What does history tell us about how to treat such issues? How are the investment team viewing this?

There is plenty to be concerned about particularly in the Middle East. Though I believe I’m correct in saying that sadly there has not been a single year since 1945 when there hasn’t been a reasonably significant war somewhere in the World. There is always lots to worry about. We could, of course, wake up one morning and find that Israel/USA have bombed Iran or China has invaded Taiwan. We have to believe, however, that these apocalyptic outcomes won’t happen and that a global reasonably capitalistic system will continue. That said, as I’ve mentioned, we have been running low risk in portfolios and we have maintained a position in gold, which hasn’t helped in the last 12 months but is helpful in the current environment.

Has the risk of an oil price spike increased? What would be the impact of this on investment markets?

Clearly, given the Middle East’s role as an oil producer and exporter, there is a material risk of a spike in oil prices. Saudi Arabia will do what it can to prevent this from lasting, as it is concerned about medium term demand destruction in a move to a ‘net zero’ World and the risks of a deep recession, and the North American shale producers will again start to ramp up supply as prices rise. So higher oil prices matter but not to the same extent as the 1970s.

How would you describe how our stock allocations are positioned? When compared to general stock markets, have our positions been good or bad, and what are we thinking going forwards?

On the positive, our continued emphasis on ‘quality’ companies, strong balance sheets, revenue growth and barriers to competition has been extremely helpful in this environment. In fact, outside Japan, where we have correctly had a ‘value’ approach to stocks for reasons to do with reductions in excess capital among quoted companies, quality has outperformed in nearly every major market and across the capitalisation range. Our emphasis, which thankfully we reduced earlier in the year, on US smaller/medium-sized companies has been less helpful.

We have seen large outperformance of a few companies year to date, what was the driver behind that? To what extent did our portfolios benefit from this? What was the rationale for owning less of them than their allocations within broad stock markets?

The driver of performance has been extreme examples of investors seeking ‘quality’ ‘growth’ companies, and being prepared to pay a high price, combined with forward looking enthusiasm for the opportunities from artificial intelligence for a small number of suppliers controlling key aspects of the technology. The enthusiasm may be overdone but the reality is the ‘mega-cap’ technology companies like Apple, Microsoft, etc. have enormous barriers to entry and absent completely game-changing new technologies are impossible to replicate today. In addition, they have huge amounts of cash on their balance sheets and continue to innovate; so, they should command a very high price on the stock market. One problem for equity funds is overcoming regulatory concentration limits on individual holdings.

Given the rise in yields we have seen large increases in the cost of borrowing, what are the implications of this?

Back to the rise in yields, the additional points to those already covered are the implications for financial market liquidity as a result of higher collateral requirements as government bonds underpin a large part of derivative contracts and the risks for borrowers from having to refinance debt at materially higher rates. This latter point is relevant to companies, governments and, of course, households exposed to higher mortgage rates. We are particularly cautious of the rising risks in the Eurozone as, for example, Italy’s 10 year borrowing cost has risen back to 5% and its government debt to GDP ratio rises to 140%, while nearly a quarter of government debt needs to be refinanced over the next year. Given the rising risks of re-financing in a World of high levels of accumulated debt, we continue to emphasise ‘quality’ government bonds but recognise we have been early on our positioning.

What is the committee’s view on inflation?

Inflation has come down rather as we anticipated but is much ‘stickier’ in, for example, the UK where there is a problem with increasingly entrenched wage increases in an economy with low or no productivity growth. We still believe that inflation will continue to fall although we are watching events in China closely. China has recently fallen into deflation, and domestic consumption and the overall economy have been weak, but there is some evidence of stimulatory actions by the central government. This is likely to help strengthen commodity prices which is partly why we continue to have good weightings in gold, oil, copper, and commodities generally. If we see a recession developing inflation could, of course, fall sharply.

Given China's current economic and geopolitical situation, the spotlight in Asia has shifted to India. What is your perspective on the Indian equity and bond markets?

I have outlined before our long-standing scepticism on opportunities in China for investors. It is fair to say the team is split on India. I am a long-standing enthusiast going back to the 1980s! For recent context, Indian equities are up c50% since their 2020 low while Chinese equities are down 40%. This has resulted in the Indian market becoming expensive in the emerging market universe. There will be better opportunities to invest as India has great demographics and is benefitting from western companies ‘friendshoring’ manufacturing capacity away from China, and infrastructure, which has always been a problem, is improving rapidly. Against this, the increasingly aggressive Hindu nationalist administration and continued high levels of corruption encourage some caution.

Manager in focus: Nomura Japan Strategic Value

Why Japan?

For over three decades, Japan’s stock market has been waiting for its moment in the spotlight. We suspected its time was coming so have been tilting portfolios towards Japan for some time.

Japanese equities have many advantages over other regions. Good quality Japanese companies trade significantly more cheaply than in many regions, the Yen is very cheap compared to recent history, its economy is not impacted by high inflation nor high interest rates, and recent shareholder reforms have made Japanese companies more shareholder friendly.

These factors have resulted in a significant increase in global investor interest in Japan, and its stock market has been one of the best performing this year.

Who are Nomura?

Nomura Asset Management (NAM) is a prominent asset management firm based in Japan. It is a subsidiary of Nomura Holdings, one of Japan’s largest financial services groups. NAM manage equities, bonds, real estate, and alternative investments, for domestic and international clients, mainly via mutual funds and exchange-traded funds (ETFs).

The company prides itself on its Japanese and Asian equity division, with Japanese equities making up nearly half of the total £400bn assets under management.

Fund Overview

This fund’s objective is to achieve long term capital growth by investing in Japanese companies. It aims to outperform the Japanese stock market (TOPIX) by 3% per annum.

It uses a bottom-up strategy, selecting individual companies they believe to be undervalued by the market. To identify such companies, it uses both quantitative and qualitative methods.

Quantitative screens cover a range of metrics, such as price to earnings ratio. The qualitative aspect provides room for adaptability to emphasize the critical factors contributing to sustained, long-term outperformance.

Investment Philosophy

The philosophy focuses on value investing, embracing a wholly bottom-up approach devoid of market capitalisation or sector preferences, instead emphasizing a long-term approach to picking quality companies that are trading on cheap valuations.

The team aims to achieve this through stock selection, leveraging market inefficiencies to generate positive returns by identifying undervalued stocks trading below their intrinsic worth.

Their definition of value has three aspects in decreasing tangibility:

Asset value

- Undervaluation based on reproduction cost (i.e. how much would it cost to set up the company from scratch)

- Potential based on catalysts (restructuring, revaluation)

Earnings Power value

- Undervaluation based on sustainable earnings

- Potential based on competitive environment and trajectory

Franchise value

- Undervaluation based on incremental return on investments

- Business quality based on sustainable barriers to entry

The process commences with idea generation, which can originate from various sources, including the use of screens, as well as organic ideas contributed by the portfolio managers and the Nomura research team. This initial step results in a pool of approximately 500 closely monitored companies.

Subsequently, a comprehensive evaluation of the company’s financials and industry positioning is conducted to assist with forecasting their earnings potential and franchise value. This assessment also encompasses the consideration of Environmental, Social and Governance (“ESG”) factors specific to the industry and product to determine the sustainability of the investment thesis. This process narrows down the selection to a shortlist of 150-200 companies that display both an undervaluation versus history and stronger earnings growth potential.

The final phase involves portfolio construction, which is executed with careful judgment and in alignment with their expected return framework to create a well-diversified portfolio. The team consistently manage position sizes and endeavours to focus on long-term fundamentals rather than reacting to short-term market fluctuations.

Their criteria for selling positions are guided by shifts in the degree of undervaluation or potential, as well as the availability of superior investment opportunities. Historically, changes to the portfolio (turnover) ranged between 25% to 35% annually.

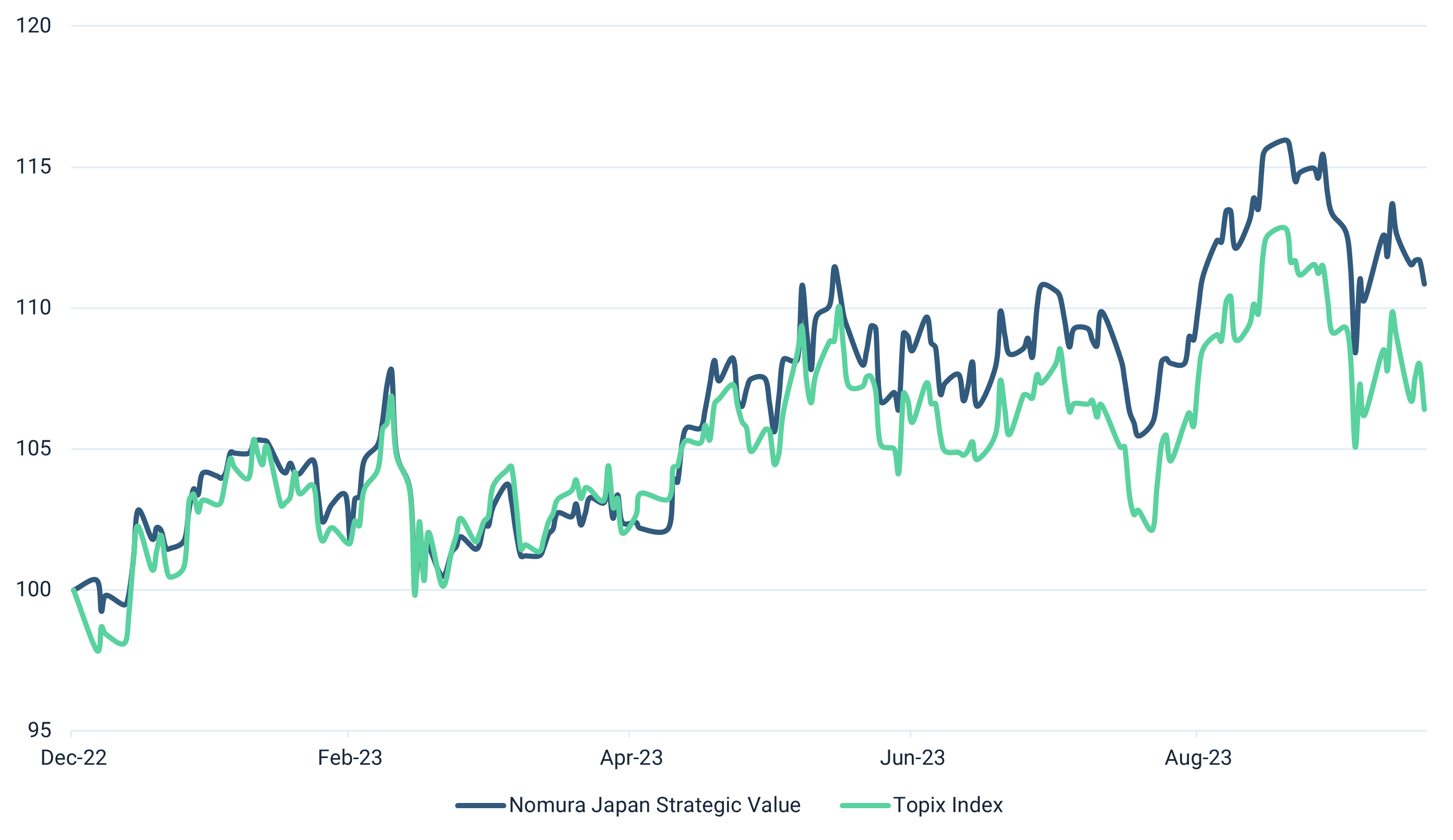

Performance

The fund has posted double digit returns since the start of the year (+10.86%):

Saltus Investment Case

Japan stands out as an exception when compared to most other major global economies, primarily due to its approach to inflation and interest rates.

In a notable shift, companies have started to raise prices for the first time in decades, and Japan’s GDP recorded a 0.4% growth in the first quarter of 2023.

While these decisions have been beneficial for the economy, they have resulted in a weakening Yen. This has led to increased costs for imports but has simultaneously boosted exports. A depreciated currency has made Japanese products more competitively priced on the global stage, particularly advantageous for a major exporting nation like Japan.

Furthermore, the Japanese stock market presents an attractive valuation proposition. Certain segments of the market are perceived as being inadequately understood and underexplored, potentially creating intriguing investment opportunities and hidden gems for discerning investors.

The team have a strong heritage in value investing, evidenced by position attribution from stock selection.

Their investment process is focused on understanding how a company can improve and change the outlook for earnings growth, which over the long run is a key determinant of share price appreciation.

Nomura have a large bank of analysts with a very strong knowledge base covering Japanese companies, given they have been a large part of the financial ecosphere for decades.

The team’s emphasis on quality business models is another key rationale for holding the fund, they have a great sense for discovering companies that can turnaround performance.

Finally, the team have a red line on leverage, appreciating that companies that have poor balance sheets and free cash flow are likely to be value traps at best or a quick route to permanently losing capital.

Saltus use this fund as part of a diversified portfolio. This is not a recommendation to invest in this fund. Saltus will not be liable for any losses incurred as a result of investing in this fund.

Asset Allocation Committee

The committee consists of several senior members of the investment team, all partners, who invest their own money alongside clients. The committee is led by:

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

The views expressed in this article are those of the Saltus Asset Management team. These typically relate to the core Saltus portfolios. We aim to implement our views across all Saltus strategies, but we must work within each portfolio’s specific objectives and restrictions. This means our views can be implemented more comprehensively in some mandates than others. If your funds are not within a Saltus portfolio and you would like more information, please get in touch with your adviser. Saltus Asset Management is a trading name of Saltus Partners LLP which is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.