Growth (economic)

The global economy is in rude health when looking at Gross Domestic Product (GDP) growth in isolation, however other growth indicators are showing signs of weakness, especially when viewed on a country-specific basis. The US continues to outshine most other countries with its economic strength, and this is expected to continue as the US Federal Reserve (The Fed) start bringing down interest rates. Fears of a ‘hard landing’ – a higher interest rate-induced economic slowdown – have receded, and we may be slowly returning to a ‘no landing’ scenario in which the economy doesn’t slowdown in any meaningful way, inflation is more stubborn, and rates have to stay higher for longer.

On the other end of the spectrum, Europe’s growth machine is stuttering, especially in the manufacturing powerhouse of Germany. Economic conditions in Germany languish in recessionary territory. Of the other major economies, the UK growth picture continues to improve, Japan remains robust, and China is on life support and requires continuous stimulus to keep going.

Inflation continues to fall on a reasonably synchronised basis. In the US, the latest release showed inflation slowing to 2.4%, this compares to Japan at 2.5%, UK at 1.7%, and Europe at 1.7%. Inflation falling towards or below target levels is giving central banks the space to reduce interest rates, with the exception of Japan which is still enjoying a comeback from its ‘lost decades’ (Japan’s Economic Renaissance | Saltus).

Unemployment numbers remain near historic lows across the board, a reflection of the tight labour supply conditions in the post-Covid economy. US jobs creation is back on the rise, but away from the headline data there are signs of softening, for example hiring rates and quitting rates are falling meaning people are less comfortable quitting their jobs, possibly because they fear a downturn or because other companies aren’t hiring. Wages are still growing at a healthy clip though, given the low levels of unemployment. With inflation coming down, this is supporting the consumer which remains a key pillar of economic growth.

Third quarter earnings have so far been positive, but there are pockets of weakness – for example, consumer companies – which could be a warning sign about a forthcoming slowdown. On the whole though corporates are still in a strong position, enjoying high margins and growing profits. Corporate spending is rising too, a signal that businesses are feeling confident in their future outlook.

Many of the above data points are lagging indicators, telling us what has happened. By looking forward at leading indicators to see what could be in store, we can generally see a positive picture. The Composite Purchasing Manager Index (PMI) is based on business survey data in both manufacturing and services, and is in expansion territory in the US, UK, Japan and China. The weak link is Europe, especially Germany.

All in all, the committee does not see any major changes in growth conditions to warrant wholesale shifts in stance.

Interest rate & liquidity environment

The Fed kicked off their rate cutting cycle with an outsized 0.5% reduction at their meeting in September. This was accompanied by commentary from Fed speakers saying they were now focusing more on the employment side of their mandate than inflation. The read from this was the Fed can see meaningful weakness in the labour market, enough to justify a larger cut. Every US data release continues to be pored over for signals over the path of interest rates from here. Given the latest strong US labour market data, the expectations for rate cuts have been scaled back. The Fed has been adamant they are data driven and so it is hard to predict what their next move will be.

Elsewhere, the gloomy data in Europe is forcing the European Central Bank into more rate cuts. The base rate is currently at 3.25% so already meaningfully lower than the US and the UK. In the UK, the Bank of England left the base rate at 5.00% at their September meeting as they want to avoid cutting too fast. Recently though Andrew Bailey, the Governor of the Bank of England, admitted they could be “a bit more aggressive” about cutting rates so we expect more to come over the coming months.

Liquidity in the financial system remains plentiful and financial conditions loose, even in the face of central bank balance sheet reductions. This is supportive of the current benign investment environment.

The committee remain of the view that we have entered a sustained rate cutting cycle now inflation looks to be under control but are aware these cuts may be slower to materialise than what is forecast.

Valuations & earnings outlook

Coming into the last quarter of 2024, analysts are still optimistic on global earnings growth and forecast 9.4% growth for 2024. The broad consensus is for strong earnings growth to continue into 2025. Emerging Markets is the area of largest expected Earnings Per Share (EPS) growth over 2024 and 2025, with the UK and Europe lagging, but still positive. Profit margins look to have rolled over in most regions.

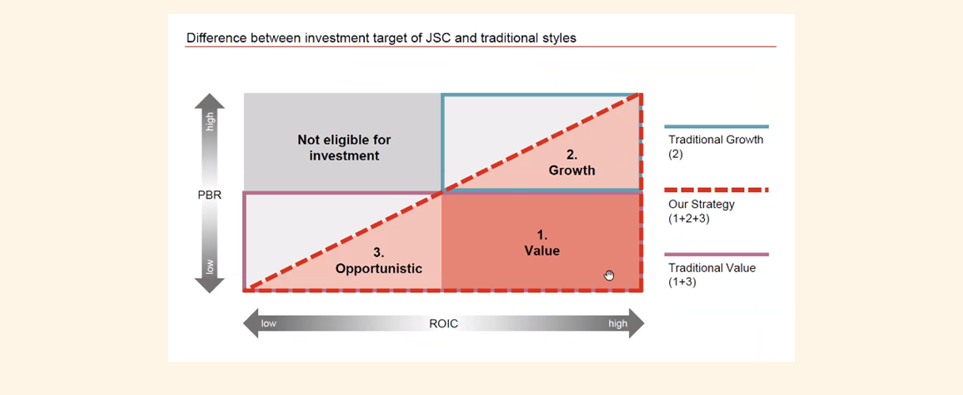

The US is the only major region meaningfully overvalued versus its history on a 10-year average price to earnings multiple. Japan and Emerging Markets are no longer cheap but in line with long term averages. Europe and the UK are still very cheap by their historical standards, justified to some extent by their earnings outlook.

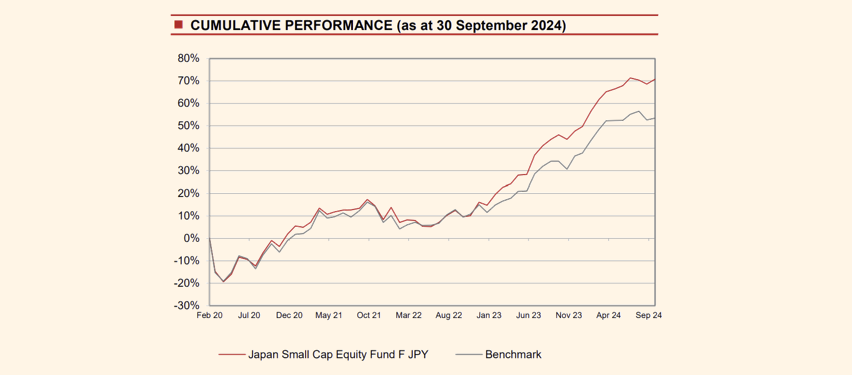

Within sectors, small companies and traditional value stocks are still cheap, but the earnings outlook for a lot of these companies is negative, which again is warranting these low valuations. This is not the case in all markets though, and we have sought exposure to UK, Japan and European smaller companies given the opportunity for active managers in these areas to outperform.

Sentiment / flows

Market sentiment is beginning to look extended. The US stock market is trading above its long term moving average, market breadth is strong meaning there is a high volume of stocks that are rising, and investors are typically not using put options to hedge their downside exposure. Market volatility is rising but still at relatively supressed levels, and stocks have been outperforming bonds. All these indicators point to positive sentiment that is at risk of becoming excessive.

A popular survey of fund managers in October registered the biggest jump in optimism since the depths of the pandemic. Allocations to stocks surged, bond exposure sank, and cash levels fell. Weekly flows into financial market assets have been strong over the last three months, above the average for 2024, based on global fund flow data.