What happened in 2023?

The positive outlook for Emerging Market (EM) investments took a hit in 2023. Initially, investors were excited about the prospect of a stronger Chinese economy, a weaker US dollar, and lower expected interest rates. Unfortunately, these expectations didn’t quite pan out, leading to lower returns. As US yields rose and the dollar strengthened, China’s recovery also fell short of what was hoped for. This disappointment caused investors to lose interest in emerging market assets, affecting both stocks and bonds to varying extents by the end of 2023. However, does that pose opportunity for investment in 2024?

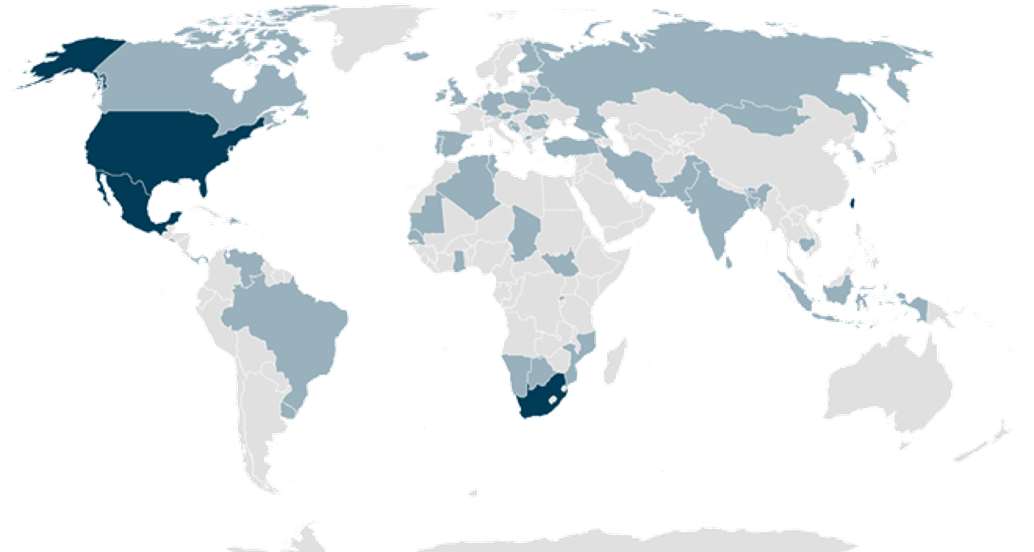

What do we classify as emerging markets?

Thinking of emerging markets as one homogeneous group could be construed as a mistake due to each country in the EM universe having their own unique characteristics. While there are shared risks like sensitivity to geopolitical events and overall risk tolerance, it’s crucial for investors to acknowledge the differences. Factors such as whether a country is an energy exporter or importer, and whether its economy is based on manufacturing or services, can create significant distinctions. These differences highlight the diversity within the group.

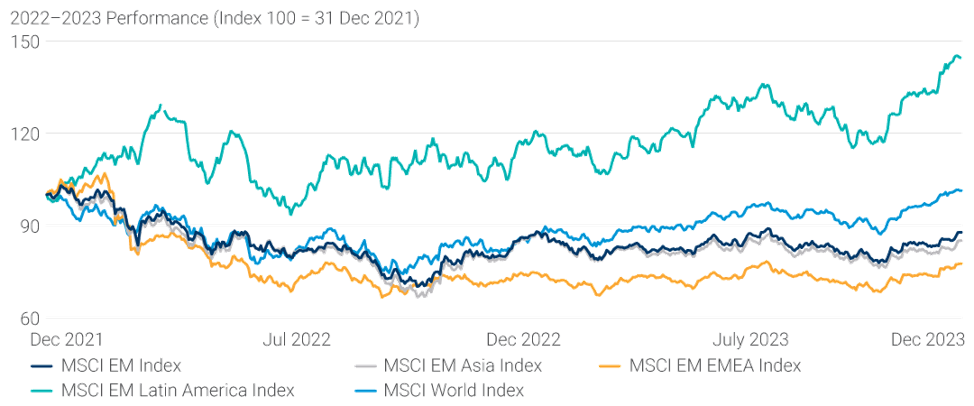

Illustrated in the graph below is the performance of different emerging market indices as defined by MSCI. Chinese stocks make up about 30% of the benchmark emerging market stock index, but only 4.7% of the debt index in hard currency and 10% of the local currency market. The rationale for investing in Chinese stocks or bonds can be quite different to that of the rest of the emerging market group. [1]

MSCI Emerging Market Indices 2022 & 2023