The last week has seen an exceptional level of turbulence in markets, particularly in the UK. Below we try to explain the background to events and our interpretation.

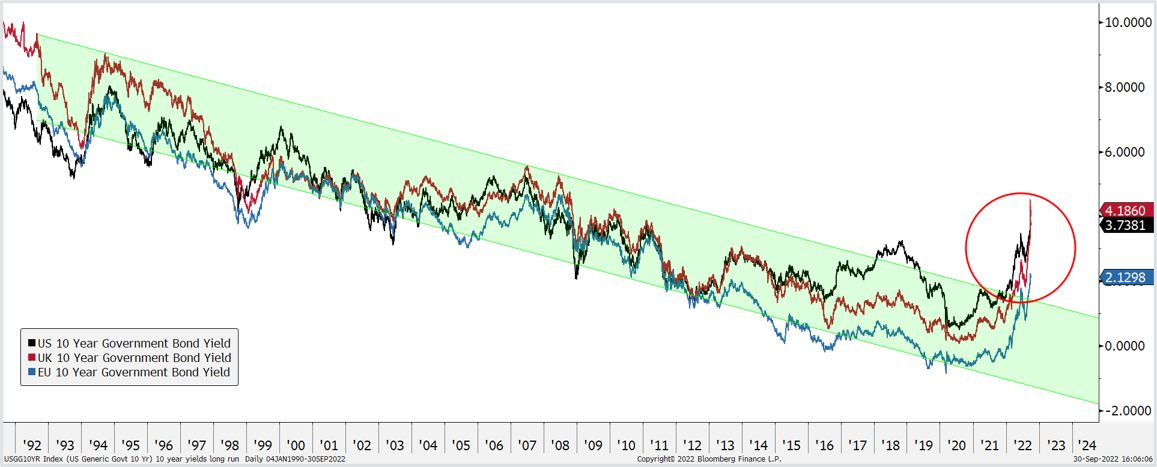

1.The global market is volatile – it’s not just the UK. This summer something important happened in world markets. The combined impacts of Covid and the energy shock from the war in Ukraine have driven inflation rates up to unforeseen levels in the developed world. This has forced central banks to sharply increase interest rates to slow demand and try to force inflation back down. By the summer of this year the ‘low inflation low interest rate’ world we had been used to for 30 + years had vanished, giving way to a new era of high inflation and higher interest rates. The graph below shows this shift into a new investment regime neatly. It plots the market benchmark borrowing rate for the US, UK and European governments since the 1990s. We can see quite clearly that a multi decade trend of falling interest rates has been decisively broken this year. We are now moving into a new era of higher inflation and higher interest rates and the transition is proving to be very bumpy.

Source: Bloomberg plot of US,UK and German generic 10 year government bond yield to 30/09/22

2. Into this environment the UK government decided to launch a ‘mini’ budget to outline their growth plans and priorities. By failing to communicate how this would be funded, why they think the plans will work in the long run, and what strategic framework for spending UK finances would be managed to, the government injected a large dose of uncertainty into a marketplace that was already skittish, nervous, and distracted with other big picture issues. This policy was also seen to act against the efforts of the Bank of England, as the tax cuts would be expected to boost inflationary pressures at the same time the Bank of England was trying to rein them in. For these reasons the announcement was seen as incoherent and lacking credibility. Confidence in UK Plc was dented, and markets reacted very quickly.

3. The pound fell sharply as a result and the rates at which the UK borrows in international markets (or gilt yields) shot up. Some pension funds were forced to sell into this turmoil as the sharp falls in bond prices led to demands from their lenders for more cash to underpin their investment strategies. This technical forced selling risked becoming a full-blown panic and in the end, the Bank of England was forced to step in and buy government bonds to calm the gilt market.

4. These events are embarrassing for the UK, as the poor communication of government strategy has ended up giving us a credibility problem with the local and international institutions the UK relies on to fund our economy. With eight auctions of UK government debt in October, we will soon find out the prices we will be borrowing at, if the market views these recent events as a shorter-term squall or something more serious and longer lasting.

5. As is often the case in markets, prices can overshoot both on the way up and the way down. The pound has fallen sharply versus the dollar but that is not particularly new news, as nearly every currency on the planet has fallen against a strong dollar this year. On a trade weighted basis the pound has definitely taken a hit because of these actions but again, this has so far only sent us back to the bottom of a trading range as opposed to falling through it. Interest rate markets are forecasting a peak in base rates at near 6% by the middle of next year, which seems very high given that we will also potentially be in a recession. It is now your investment committee’s job to see if these prices (and elsewhere including UK equity markets) offer up more of an opportunity than a threat.

6. Saltus portfolios are global in nature and, although our lives are dominated by UK centric issues, our investment portfolios are not. The very large majority of investments are outside the UK, which offers us a high degree of insulation from these events. In many ways, as hinted at before, it may even offer up a solid long-term opportunity, after the government has a chance to re-present its case with more detail and hopefully some external check on the numbers.

7. In summary the events in the UK are impactful and negative to UK assets but, given the pivotal shifts in global markets in general as we deal with a higher inflation world, they are also just additional noise in an already noisy environment. We have been through many volatile periods in the past and know that well-constructed portfolios can not only ride out the bumps but also regularly take advantage of the opportunities they present. We suspect the recent turbulence will follow this familiar pattern.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

The views expressed in this article are those of the Saltus Asset Management team. These typically relate to the core Saltus portfolios. We aim to implement our views across all Saltus strategies, but we must work within each portfolio’s specific objectives and restrictions. This means our views can be implemented more comprehensively in some mandates than others. If your funds are not within a Saltus portfolio and you would like more information, please get in touch with your adviser. Saltus Asset Management is a trading name of Saltus Partners LLP which is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

Related blog posts

About Saltus?

Find out more about our award-winning wealth management services…

Winner

Best Wealth Manager

Winner

Investment Performance: Cautious Portfolios

Winner

Top 100 Fund Selectors 2024

Winner

Best Places to Work 2024

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate