In recent weeks, global events have made headlines and sparked discussions among investors. From heated political exchanges in the U.S., to a strong display of European unity overcoming post-Brexit tensions and the latest tariffs imposed on Canada, China, and Mexico by the U.S., there’s no shortage of geopolitical drama.

With so much happening, it’s natural to wonder how these developments might impact financial markets. While news cycles often amplify uncertainty, it’s important to distinguish between media-driven sensationalism and the actual effects these events have on investments. Not every headline translates into market turmoil, and history shows that markets tend to adapt and refocus on long term fundamentals rather than short term political noise.

Understanding this distinction can help investors stay focused on their financial goals without being swayed by every twist and turn in global affairs.

How should investors view geopolitical volatility?

While geopolitical tensions are higher than usual, they are far from reaching extreme levels.[1] However, the current climate of political division has increased market volatility, making uncertainty feel more pronounced.[2] Investors are responding by taking precautionary measures, such as hedging their portfolios with options, essentially an “insurance” against potential downturns.

Intelligent investing for portfolios over £250k

Find out how to generate risk adjusted returns like a professional...

At the same time, there’s a risk of being overly cautious. If market sentiment shifts; say, from concerns over tariffs to optimism around tax cuts or a breakthrough in global conflicts like Ukraine, investors who stay too defensive may miss out on potential gains.

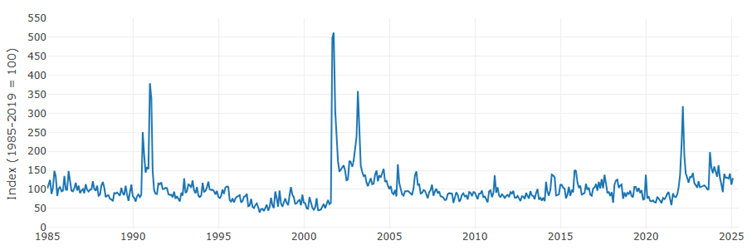

To get a clearer picture of these risks, the Geopolitical Risk (GPR) Index, developed by Caldara & Iacoviello, offers valuable insights.[3] It highlights two key trends: geopolitical risk naturally fluctuates, with minor ups and downs being common, while major spikes in the index typically align with significant global conflicts. Understanding these patterns can help investors make informed decisions rather than reacting to every headline.

Source: Caldara & Iacoviello GPR Index[4]

Recent sharp increases in the GPR were largely driven by the Russian invasion of Ukraine in 2022 and Chinese military manoeuvres near Taiwan in 2023.[5] At present, however, the GPR remains only slightly above its long term average, suggesting that while risks are elevated, they are not yet at extreme levels as seen in 2001 for example.

However, looking at the situation from a different angle, we can examine the risk of events escalating out of control. Timbro’s Populism Index indicates that as of 2023, more than a quarter of voters were supporting radical political parties in Europe.[6] This figure rises even further when we consider the most recent European elections in 2024 and the February 2025 German election, where the share of voters backing extreme parties approached 30%. The increasing influence of these parties can make it more difficult to achieve political consensus and could potentially accelerate the escalation of issues, particularly if the polarisation deepens.

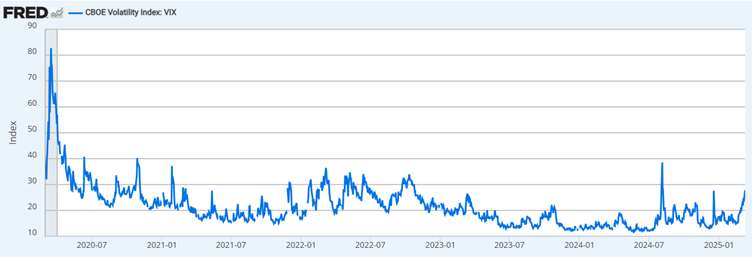

Although the geopolitical risk index may appear subdued, this increasingly fractious political landscape suggests that caution may still be warranted. It’s important to note that the VIX index, which measures market tension, doesn’t always correlate with the geopolitical risk index.[7] While geopolitical crises often make the headlines, some of the most severe market downturns in history, such as during the global financial crisis or the early stages of the COVID-19 pandemic; occurred in times of relative geopolitical calm. What truly drives market disruption is not just the rhetoric around geopolitical tensions, but the economic impact of these tensions.

5 Year VIX Index

Source: FRED Economic Data, CBOE [8]

Although the geopolitical risk index remains relatively subdued, investors are still responding to the uncertain environment. By the end of February 2025, many were paying a premium for downside protection, signalling caution amid ongoing global tensions.[9] At the same time, investors have continued to buy into the market, suggesting that while investors are hedging against potential risks, they are also wary of missing out on potential gains. If geopolitical concerns ease or attention shifts toward more positive economic developments, markets could see renewed optimism, highlighting the delicate balance between risk management and opportunity.

Trump tariffs

The reality of President Trump’s tariff policies is starting to set in, with significant tariffs now being imposed on North American trading partners. While he campaigned on raising tariffs by as much as 60% on Chinese imports, the surprise this year has been the 25% tariffs on the free trade zone between the U.S. and its neighbours, Canada and Mexico, albeit currently on hold.[10]

Since President Trump’s election, both Mexico and Canada’s currencies have weakened by about 4%, with additional pressure building in anticipation of the tariff changes.[11], [12] However, it’s U.S. assets that are now feeling the biggest impact, particularly as domestic consumer confidence falls due to inflation concerns.

The U.S. dollar index, which tracks the value of the U.S. dollar against major currencies, has dropped more than 4% from its peak earlier this year. U.S. equities are underperforming their global counterparts, with the S&P 500 down 5% year-to-date as of March 31st.[13] Meanwhile, the Trade Policy Index, which measures trade policy uncertainty, has surged above levels seen during the supply chain disruptions caused by the pandemic.[14]

Rising concerns over tariffs, combined with spikes in consumer prices, have led to a drop in U.S. consumer confidence this year, and business confidence is expected to follow suit.[15]

Table 1: illustrates expected retaliatory tariffs for the US’s largest trade partners:

| Top 10 US Trade Partners (%) | ||||

|---|---|---|---|---|

| Trade partner | Effective Tariff Rate | Trade Partner's Effective Tariff Rate on US | Trade Partner's Exports to the US as % of GDP | Potential Revenue to US from Reciprocal Tariffs ($BB) |

| China | 2.86 | 7.13 | 3.2 | 24.58 |

| Euro Area | 2.22 | 1.5 | 3.57 | - |

| Mexico | 0.01 | 5.17 | 32.47 | 23.69 |

| Canada | 0.12 | 1.08 | 20.87 | 4.28 |

| Japan | 1.58 | 3.9 | 3.65 | 3.59 |

| Vietnam | 4.63 | 2.85 | 33.24 | - |

| South Korea | 0.01 | 14.39 | 7.26 | 17.38 |

| India | 2.99 | 9.45 | 2.69 | 5.88 |

| United Kingdom | 1.32 | 0.69 | 2.11 | - |

| Thailand | 0.85 | 6.19 | 12.72 | 3.36 |

| Top 10 Total | 82.75 | |||

| Rest of World | 2.15 | 3.57 | 1.47 | 10.77 |

Source: World integrated trade solutions[16]

The companies listed on the S&P 500, which earned nearly $2 trillion in operating profits last year, will now face a large share of the costs associated with these tariffs. These firms will either absorb or pass on the additional costs to consumers in the coming months, depending on how long the tariffs remain in place or are expanded, which ultimately could impact share prices.

A well-diversified portfolio, encompassing many geographies and asset classes, remains one of the most effective ways to navigate market uncertainties, including major policy shifts like the Trump administration’s view on global tariffs.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

So far this year, the strong performance of global equities, particularly Europe and Asia and government bonds has helped diversified portfolios stay in positive territory, proving that a balanced approach can provide resilience even in a challenging economic landscape.[17]

Building portfolio resilience

For investors with multi-asset portfolios, there are still many ways to build resilience in the face of geopolitical risks. Geopolitical tension will often affect economies in two ways: it can undermine confidence and demand, leading to a negative growth shock, or it can disrupt supply, resulting in an inflation shock.

Recent price movements in U.S. Treasuries indicate that bonds remain a solid option as growth expectations begin to moderate. In the event of a growth shock and a significant drop in interest rates (around 2%), government bonds from the U.S., UK, and Germany could provide returns of approximately 20%.

Our view is to maintain a balanced approach, diversifying between growth and defensive strategies, and keeping flexibility to seize emerging opportunities. Sectors such as private assets and alternatives may offer attractive avenues for growth and risk management, while holding some cash reserves could provide the agility needed in a dynamic market environment.

In simple terms, our strategy is to favour bonds and alternatives during growth shocks, real assets during inflation shocks, and an active approach to navigate through uncertain times.

You can find out more about how we have recently positioned our portfolios here: Asset allocation update February 2025 | Saltus

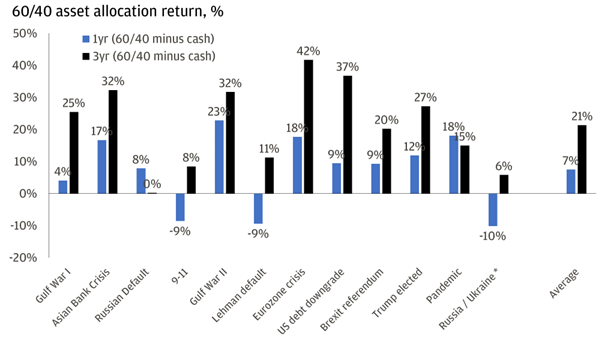

Some investors might believe that holding cash is a “safe haven” asset during periods of geopolitical tension. Below is a chart showing market crashes since 1990 to compare how cash has performed versus a typical balanced allocation. (Cash is defined as return of 3-Month T-Bill. Balanced allocation being 60% MSCI World Index & 40% Bloomberg Global Aggregate Index).

Source: Bloomberg, JP Morgan[18]

After one year, the balanced portfolio outperformed cash 75% of the time, with an average return advantage of 7%. After three years, the balanced portfolio outperformed cash in every case, with an average outperformance of 21%. These are the market returns and do not account for any fees for investing.

You can read more about our view on why cash isn’t always king here: Cash savings vs investing | Saltus.

While the media may emphasise acute geopolitical risks, the data suggests that such tensions are lower than often portrayed. Even if we are in a more volatile environment, hiding in cash is not a strategy that leads to success. As the saying goes, “It’s time in the market, not timing the market,” that leads to long term success.

Disclaimers:

- Past performance does not guarantee future performance.

- Prices and rates of return are subject to change based on market conditions.

- Bonds carry risks such as interest rate risk, credit risk, and issuer default risk. Typically, bond prices decrease when interest rates increase.

- Equity securities can experience price fluctuations due to market-wide changes or variations in a company’s financial health, which can occur swiftly and unpredictably. Stocks are exposed to “stock market risk,” meaning that their prices can decline over both short and extended periods.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

The views expressed in this article are those of the Saltus Asset Management team. These typically relate to the core Saltus portfolios. We aim to implement our views across all Saltus strategies, but we must work within each portfolio’s specific objectives and restrictions. This means our views can be implemented more comprehensively in some mandates than others. If your funds are not within a Saltus portfolio and you would like more information, please get in touch with your adviser. Saltus Asset Management is a trading name of Saltus Partners LLP which is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

Related blog posts

About Saltus?

Find out more about our award-winning wealth management services…

Winner

Best Wealth Manager

Winner

Investment Performance: Cautious Portfolios

Winner

Top 100 Fund Selectors 2024

Winner

Best Places to Work 2024

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate