In your mid-40s, with £250,000 in your pension pot? Wondering if you really have to wait until 67 to retire? Well, perhaps not – with a little bit of planning and investing, you could retire early.

Determining your retirement expenses and setting realistic goals

The Pension and Lifetime Savings Association and the University of Loughborough have researched the amount required per annum to provide a ‘comfortable retirement.’ They concluded that, for an individual, it was around £37,300 a year. This sum certainly isn’t a lavish figure: it’s enough to provide £144 a week on food, enjoy three weeks of holiday in Europe, and spend around £1,500 a year on clothes, shoes, and gifts.[1] So, perhaps ‘mildly comfortable’ might be a more accurate description.

Saving strategies for an early retirement

How can you easily save for a more comfortable, early retirement? If your starting point is £250,000 in your pension, to achieve this, you’ll need to save and invest around £1,000 a month. If you are earning £80,000, that’s 15% of your annual salary. Of course, the majority of that could be made up by employer pension contributions, meaning a good chunk of it may not have to come out of your pocket. If you’re 45 today and your pot and monthly contributions are invested well, making a reasonably conservative 4% a year, by the time you arrive at your 60th birthday, you’ll have just under £700,000.

The 4% Rule: A helpful tool for early retirees

William Bengen is an economist famous for creating the 4% rule after analysing 50 years of historical returns across every asset class. He determined that in all circumstances, regardless of when someone retired over the 50 years, they could take annual withdrawals of 4%, and the pot would always last 30 years. By applying this rule, you could take £28,000 a year from your £700,000 retirement pot. Not quite a comfortable retirement but almost. However, you’ve probably done some quick sums – if it did run out in 30 years and you retired on your 60th birthday, your 90th birthday could be a pretty miserable one…

How much do you need to retire and more…

How much income do you need to be comfortable, how much do you need invested and how to pay less tax...

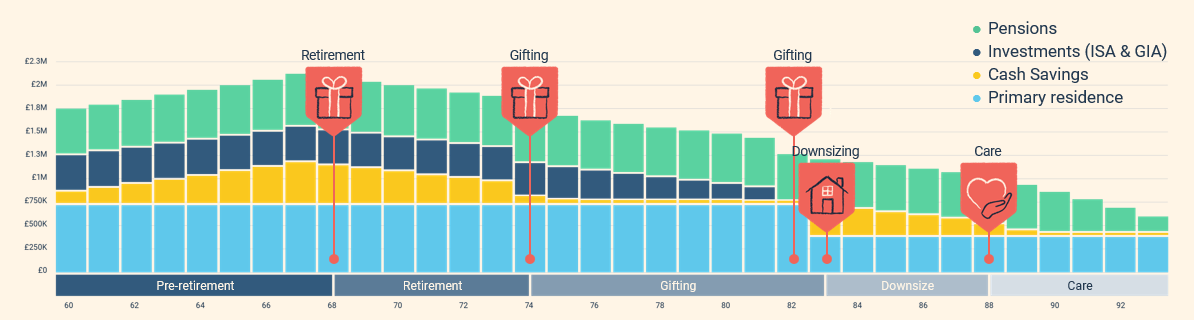

There are some flaws in Bengen’s approach though and it really should just be taken as a rough rule of thumb rather than Gospel.[2] To more accurately determine the required investment amount for your retirement, the best approach is to work with an adviser to create a customised cash flow plan. The plan can account for various factors that will more closely reflect real life such as variable withdrawals, capital expenditures, and the flexibility to accommodate different market returns. You can also stress test some of the plan’s assumptions, which helps ensure a more comprehensive and reliable assessment of what you will personally need for retirement. Of course, even this is based on assumptions so updating the cashflow on an annual basis, and as life changes, is equally as important as creating your initial plan.[3]

An example cashflow plan can be found below:

The importance of the State Pension in early retirement

Fortunately, if you’ve made around 35 years of National Insurance contributions, you should be eligible for a full state pension of just over £10,500. [4] For the first seven years of retirement, you’ll have to draw entirely from your own assets, but your state pension should be a real game-changer. Due to the additional £10,500 of income (increasing with inflation), your pot should now last well into your late 90s, and you can close in on that comfortable retirement figure of £37,000 per annum.

Optimising investments and minimising tax in retirement

Investing your money across different across different tax wrappers, to reduce the tax you’ll pay in retirement, is paramount as the £37,000 is very much a net figure. The investment strategy you employ will also be of equal importance to ensure your pot is growing at a sufficient rate to reach your early retirement objective. Two areas that are likely most effectively overseen by professionals.

So, if you’re in your 40s and have £250,000 in your pension pot and want to retire early, get planning, get investing, and maybe take some advice!

Do you need help with your retirement planning?

Our specialists can help you prepare for retirement and provide ongoing advice once retirement has arrived. Get in touch to discuss how we can help you.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

Saltus Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

About Saltus?

Find out more about our award-winning wealth management services…

Winner

Best Wealth Manager

Winner

Investment Performance: Cautious Portfolios

Winner

Top 100 Fund Selectors 2024

Winner

Best Places to Work 2024

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate