Investing in AIM shares can provide 100% inheritance tax relief, saving you up to 40% in tax. It’s also one of the fastest ways available to reduce your inheritance tax position, as AIM shares typically attract inheritance tax relief within two years. They are quite a specialist option though, and certainly not appropriate for everyone. However, in the right situation and with the right advice, they do offer an interesting solution to individuals looking to shelter funds from inheritance tax.

What is business relief?

Business relief was introduced in the 1970s, primarily for family businesses. Its main aim was to ensure that small businesses could continue to trade after the death of the owner, without having to be sold or broken up to cover the inheritance tax bill. Over time, governments have broadened its application to include most trading companies that aren’t listed on a main exchange. This was in an effort to aid growth and drive investment, by offering tax breaks for the increased level of risk associated with investing in smaller companies. The long history of business relief does help provide confidence that it can stand the test of time. It’s important to consider though, that business relief is a high-risk option and the rules can easily be changed. Nonetheless, it is quite unlikely that changes would be made retrospectively to investments already made.

What qualifies for business relief?

The investment should be into a company that isn’t listed on a major exchange and that is trading. There are also certain industries and business types that are excluded from the relief. If the company deals in securities, land and buildings, stocks and trading, or its activity is primarily focused on holding investments, it won’t attract business relief. If the company only has some exposure to activities of this nature, it’s important that they’re responsible for less than 50% of its turnover. Only the qualifying part of the company’s value will be eligible for relief.

Watch our webinar

Protecting your most important assetIn conversation with Jack Munday and Jordan Gillies

Why use an AIM portfolio?

First, it’s important to say that if tax relief is the primary reason for your investment, you need to consider the potential investment risk at great length. The reason the relief is so attractive is that these are particularly high-risk investments. They are also less liquid than many listed investments, so they can’t always be sold quickly and easily. In addition, you must hold the investments when you die for the relief to be applied. Therefore, if you are going to need to access these investments and can’t suffer volatility, they are unlikely to be suitable.

That said, if you need your money to receive an inheritance tax exemption quickly, these can be a great option. Significant lifetime gifts, whether made directly to a beneficiary or to a trust, typically take seven years to fall completely out of your estate, so it can become a bit of a gamble in later life. This is why investments that attract business relief are more commonly deployed for older clients who have greater clarity as to the level of assets they’ll need to provide their income until death. There are few other options that provide full relief in as little as two years. If you have a regular income from a pension, employment or dividends, and you can evidence that an excess is available, the excess can be gifted and will fall out of your estate immediately. There is also an annual £3,000 gifting allowance available each tax year. However, these routes don’t help people who have built up large capital sums or aren’t generating high levels of income. You may also want to retain control of your investments until death. As such, AIM shares may feel more comfortable than simply giving your money away every year. It’s worth noting though that, although they become exempt from inheritance tax after two years, AIM shares will still form part of your estate and so will count towards your £2 million asset threshold for the purpose of the residence nil rate band.

Do you need help with inheritance tax planning?

Our team are well-versed in estate planning. Our advisers can guide you through the options to make the right decision for you and your family. Get in touch to discuss how we can help you.

Use a specialist AIM portfolio manager

It’s worth taking advice from a specialist who can provide a diversified investment solution, rather than selecting companies on your own. Retail investors are unlikely to have the expertise to select a wide range of suitable companies, so it’s best left to the experts. They will typically create a portfolio of AIM investments diversified across around 20 or 30 different companies. They’ll also ensure that they are diversified across sectors to aid potential performance and reduce exposure to a single area of the economy. Whilst it’s still likely to be volatile, this should help to reduce the potential risks of the portfolio. The entire portfolio should also be ISA eligible so, if it’s held within your ISA, it will be exempt from income and capital gains tax in addition to attracting the inheritance tax relief.

It’s also worth flagging that the risk is somewhat reduced if markets have fallen in value. If markets have already suffered significant loss, this may reduce the chances of them falling further. Whilst this is something to be mindful of, it’s impossible to time any investment effectively so this should not be a feature of your decision making.

An example of how business relief might help a potential investor:

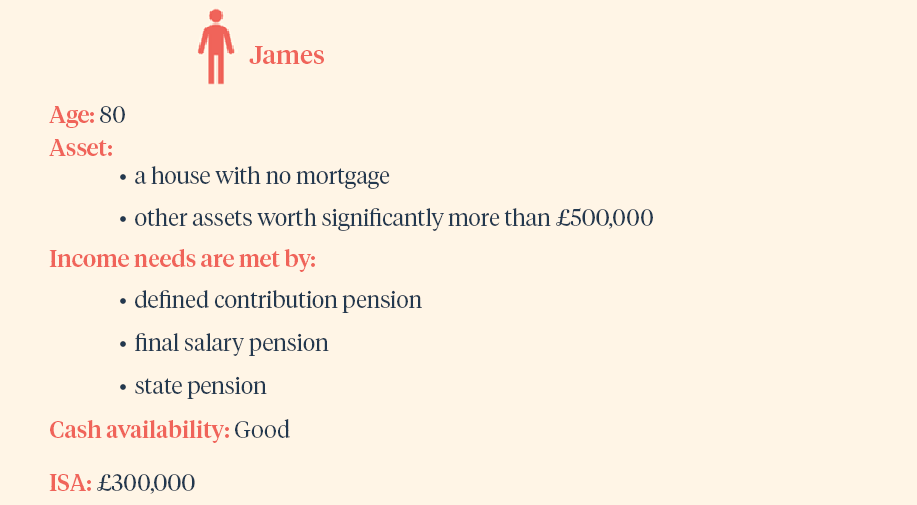

James is concerned that, if he were to die in the near future, there would be a significant inheritance tax bill for his children to benefit from his money. Assuming an annual growth rate of 4% and annual charges of 1.5%, if James died at the age of 85, his ISA would be worth £339,422. Due to the value of his other assets, this would then be subject to a 40% tax charge. That will leave his children with £135,768.80 to pay in tax and an inheritance of £203,653.20 in respect of this investment.

If, instead, James sold his holdings within his ISA and re-invested the proceeds into an AIM portfolio that qualified for business relief James’s AIM portfolio would be worth just over £336,000 on death. This again, assumes a growth rate of 4% and the same ongoing charges, but includes an additional 1% fee for the initial advice. As he held these investments for longer than two years, the full amount would be inherited by his children, thereby saving them over £135,000 in tax.

It can be quite a compelling option, if your circumstances mean it’s suitable, but you certainly shouldn’t consider it lightly and should seek professional advice. If you feel business relief might be for you and like the sound of a large inheritance tax break, maybe give an AIM portfolio some thought.

Do you need help with inheritance tax planning?

Our team are well-versed in estate planning. Our advisers can guide you through the options to make the right decision for you and your family. Get in touch to discuss how we can help you.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

Saltus Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

About Saltus?

Find out more about our award-winning wealth management services…

Winner

Best Wealth Manager

Winner

Investment Performance: Cautious Portfolios

Winner

Top 100 Fund Selectors 2024

Winner

Best Places to Work 2024

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate