Albert Einstein once famously quoted ‘compound interest is the eighth wonder of the world. He who understands it, earns it…He who doesn’t, pays it’.[1]

I’m not here to say that one of the most influential physicists and Nobel prize winners was wrong, but rather clarify his message. Compound interest, in combination with great financial planning, is the true eighth wonder of the world.

Establishing your financial goals

Before starting the conversation of how to plan better for retirement, we need to establish what the end goal, or goals, actually look like. For some, this may be looking to afford a certain holiday every year or being able to pass wealth to future generations. For others, it may just be maintaining their standard of living in retirement. Everyone’s goals look different as no retirement is the same. Although, as a young professional it may feel like retirement is too far away to think about, having an idea of what you want from retirement can dramatically help a financial planner in devising a route ahead.

Why cash isn’t always king

How much do you need to retire and more…

How much income do you need to be comfortable, how much do you need invested and how to pay less tax...

For the last 2 years, returns on cash have been higher than they have been for nearly 20 years in the UK.[2] A common conversation I have with clients stems from the question: “Why invest in the stock market when I can get a guaranteed return on cash?”.

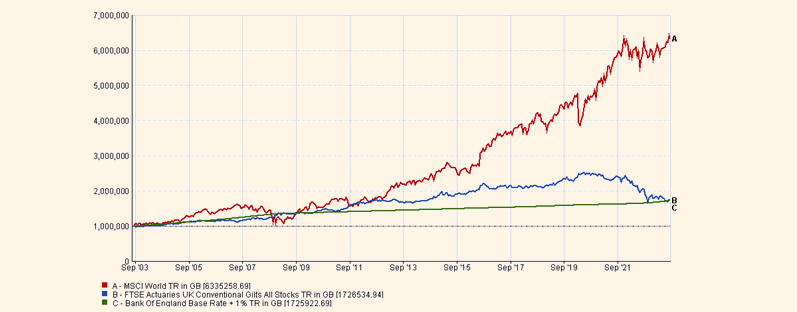

Cash is a vital part of any financial plan, but it shouldn’t be the financial plan. What I mean by this is everyone should have an emergency fund that is held in cash or cash equivalent products. However, particularly for those in the accumulation phase of their lives, it is not an optimal long-term strategy for building wealth. Furthermore, great tax planning can far outweigh returns on cash, even in struggling investment markets. Take the below chart for example. This shows a 20-year comparison of the returns on cash, bonds and a global investment fund tracking the performance of the world’s largest companies. The global equity fund has significantly outperformed the other two asset classes.

Source: FE Analytics – Accessed[3] Cash savings vs investing | Saltus

The above chart shows the journey of £1 million invested into global stocks in red (MSCI World), bonds in blue (UK government bonds), and cash in green (using the Bank of England base rate + 1% as a proxy for cash). The differences after 20 years are startling:

| Values of £1m after 20 years | |

|---|---|

| Global stocks | £6,335,259 |

| UK bonds | £1,726,535 |

| UK cash | £1,725,923 |

With smart planning and an investment strategy suited to the investor, a solid financial plan should outperform a cash-based savings strategy over the longer term.

Do you want to improve your tax position?

The more tax you pay, the harder your investments must work to grow your wealth. Our advisers can provide practical advice to help reduce your tax bill. Get in touch to discuss how we can help you.

Cash savings vs financial plan

Let’s see the difference a great financial plan can make to ‘Jimmy’; a 30-year-old working professional, with the following assumptions:

- Salary in 2024 of £130,000 gross at age 30

- 5% pension contributions through auto-enrolment

- Annual return on cash 3% sustained for 30 years (although you may see cash rates of 5% and sometimes even higher, this isn’t a true reflection of the return on cash over a longer time period – think back to just a few years ago where we were lucky to get 0.1% on our savings!)

- Annual family expenditure of £40,000

- Retirement at age 60 (30 years’ time)

Scenario 1

Jimmy receives no financial or investment advice in his lifetime. All of his surplus income is saved into his fixed rate savings account at 3%. As an additional rate taxpayer, any interest is taxable. [3]

| Age | Cumulative contributions | Value of savings/investments | Cumulative tax and national insurance paid |

|---|---|---|---|

| 40 | £400,000 | £446,876 | £627,035 |

| 50 | £800,000 | £917,572 | £1,370,926 |

| 60 | £1,200,000 | £1,372,697 | £2,199,581 |

Scenario 2

Jimmy recognises the need to make his funds work harder for him in order to reach his retirement plans – He wants to retire at age 60 with income of £40,000 net in today’s terms. He is working with a financial planner utilising firstly his pension annual allowance, as well as the use of an annual ISA allowance to maximise the end result.[4] Making pension contributions has reduced his income tax liability by both regaining his personal allowance and extending his marginal income tax bands.[5] For this, we have used an annualised growth rate of 4.75% which has been determined by Jimmy’s risk assessment and wider circumstances to determine his risk profile (A moderately adventurous growth figure for a 30 year period, net of all fees).

| Age | Cumulative contributions | Value of savings/investment | Cumulative tax and national insurance paid |

|---|---|---|---|

| 40 | £435,327 | £663,940 | £497,968 |

| 50 | £889,590 | £1,461,234 | £1,083,595 |

| 60 | £1,356,574 | £2,418,986 | £1,704,923 |

From the example above, we can see that there are two very different end results, with an almost 100% increase in scenario 2 at age 60 vs scenario 1 at the same age. This stems from two key principles:

- Historically, investments have outperformed cash over the longer-term. [6]

- Tax planning which maximises the amount that is working towards retirement goals as opposed to being paid to HMRC as a tax on savings. We have fully regained Jimmy’s £12,570 personal allowance where he pays 0% income tax, and his £500 personal savings allowance as a higher rate taxpayer.

It is clear that the two scenarios have very different outcomes for Jimmy and his family. Although scenario 1 is not a bad outcome, his retirement could be so different when compared to scenario 2 which involves making tax efficient contributions to various tax wrappers during his lifetime in order to prepare for retirement. Capital is at risk in scenario 2 in order to generate the difference and though there are no guarantees of outcomes, there are countless studies that show an outperformance of investments vs cash over longer time periods.

Summary

In comparing the two scenarios, Jimmy’s working life (age 30 to 60) shows a substantial tax and National Insurance saving of £494,668 alongside a financial plan tailored to his retirement goals. This approach has resulted in a significantly improved overall outcome upon reaching his retirement age – Hence, my first point, compound interest coupled with a sound financial plan, might rightfully be deemed the true 8th wonder of the world.

These compounded effects stem from two fundamental principles: investments consistently outperforming cash over extended periods and strategic tax planning aimed at minimizing lifetime tax obligations for Jimmy.

In the first section of this article, we delved into the essence of what compound interest is. For young professionals, having a longer time horizon gives them a greater opportunity to take advantage of the benefits of compounding interest. Planning early increases the likelihood of achieving objectives such as retiring earlier, buying the dream holiday home, going on a particular holiday each year. The later they start the more difficult it becomes to take advantage of the tax benefits and longer-term benefits of compounding through financial planning – Not impossible, but definitely more difficult!

Do you want to improve your tax position?

The more tax you pay, the harder your investments must work to grow your wealth. Our advisers can provide practical advice to help reduce your tax bill. Get in touch to discuss how we can help you.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

Saltus Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

About Saltus?

Find out more about our award-winning wealth management services…

Winner

Best Wealth Manager

Winner

Investment Performance: Cautious Portfolios

Winner

Top 100 Fund Selectors 2024

Winner

Best Places to Work 2024

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate