Retirement spending patterns

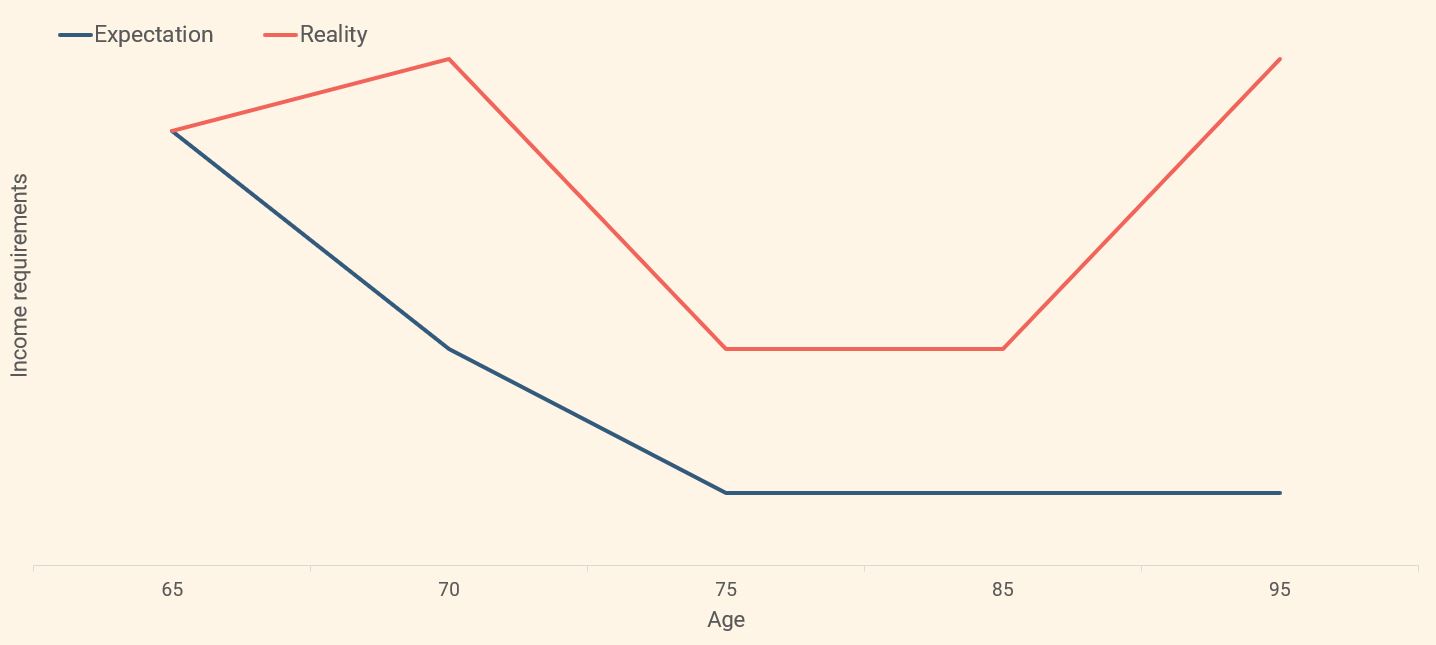

The ‘retirement smile’ is commonly referred to in the industry – it’s essentially a visual representation of typical spending patterns in retirement:

From age 65 to 70, most people are still in good health and pretty active. Retirees in this age group suddenly find themselves with more time on their hands and want to make the most of it: they take that round the world trip, go out for those fancy dinners and, of course, spoil the grandkids. As a result, their expenditure can increase quite significantly to pay for these lifestyle changes.

Do you need help with your retirement planning?

Our specialists can help you prepare for retirement and provide ongoing advice once retirement has arrived. Get in touch to discuss how we can help you.

The idea that we suddenly turn into some kind of ‘retirement vegetable’ at 65 is obscene. There is a very active part of retirement for at least the first 5-10 years that needs funding. It’s only in your mid-70s that your spending will start to substantially reduce as you hit the ‘book reading phase’ of retirement.

Full-blown ‘vegetablism’ doesn’t hit for most until they are around 85 and, at this point, spending tends to shoot right back up again due to social care and medical costs.

Enjoying your retirement

We are all different, and my retirement journey might look very different to yours. However, generally this period of our lives should be about doing the things we have always wanted to and having full freedom to do so. This is your ‘life 2’, so it is imperative you plan and enjoy it, but it’s also vital to ensure you have sufficient assets to provide the financial freedom to make it happen.

Yes, your mortgage might be paid off when you hit retirement but it still amazes me that people often knowingly plan for their income to reduce by half or possibly even more.

There are two things I want you to take away from this:

1. When you are working out how much you need, assume your spending might actually increase in the initial stage of retirement. Stop planning for your income to take a big hit at this point – it’s not realistic.

2. You have to remain flexible. Retirement is something you need to work at and review on an ongoing basis. You have to build in the ability to change depending on what life throws at you. Spending patterns in retirement are unlikely to simply decline in a continuous and predictable fashion until death.

So, if you’ve been planning for your spending to drop when you retire, maybe it’s time for a rethink.

Do you need help with your retirement planning?

Our specialists can help you prepare for retirement and provide ongoing advice once retirement has arrived. Get in touch to discuss how we can help you.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

Saltus Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

About Saltus?

Find out more about our award-winning wealth management services…

Winner

Best Wealth Manager

Winner

Investment Performance: Cautious Portfolios

Winner

Top 100 Fund Selectors 2024

Winner

Best Places to Work 2024

£8bn+

assets under advice

20

years working with clients

350+

employees

97%

client retention rate